Consumer Insurance Contracts Act 2019

Number 53 of 2019

CONSUMER INSURANCE CONTRACTS ACT 2019

REVISED

Updated to 1 January 2023

This Revised Act is an administrative consolidation of the Consumer Insurance Contracts Act 2019. It is prepared by the Law Reform Commission in accordance with its function under the Law Reform Commission Act 1975 (3/1975) to keep the law under review and to undertake revision and consolidation of statute law.

All Acts up to and including the Local Government (Maternity Protection and Other Measures for Members of Local Authorities) Act 2022 (52/2022), enacted 21 December 2022, and all statutory instruments up to and including the Planning And Development And Foreshore (Amendment) Act 2022 (Commencement) Order 2023 (S.I. No. 1 of 2023), made 9 January 2023, were considered in the preparation of this Revised Act.

Disclaimer: While every care has been taken in the preparation of this Revised Act, the Law Reform Commission can assume no responsibility for and give no guarantees, undertakings or warranties concerning the accuracy, completeness or up to date nature of the information provided and does not accept any liability whatsoever arising from any errors or omissions. Please notify any errors, omissions and comments by email to

revisedacts@lawreform.ie.

Number 53 of 2019

CONSUMER INSURANCE CONTRACTS ACT 2019

REVISED

Updated to 1 January 2023

CONTENTS

3. Amendment of Schedule 2 to Central Bank Act 1942

4. Amendment of section 60 of Financial Services and Pensions Ombudsman Act 2017

5. Regulations and codes of practice

6. Effect of codes of practice

8. Pre-contractual duties of consumer and insurer

9. Proportionate remedies for misrepresentation

10. Provision of information relevant to contract of insurance and interpretation of certain terms

11. Right to withdraw from contract of insurance by notice: cooling-off period

12. Renewal of contract of insurance

13. Cancellation of contract of insurance

14. Duties of consumer and insurer at renewal

15. Post-contractual duties of consumer and insurer

16. Claims handling: duties of consumer and insurer

16A. Mutual duties of disclosure in claims handling

16B. Disclosure of deductions from claim settlement

18. Proportionate remedies and claims handling

21. Right of third party to claim against insurer

22. Supplemental provisions in relation to section 21

23. Subrogation: modification in family and personal relationships and in employment

24. Subrogation: distribution of recovered funds

25. Contracts affecting subrogation and third parties

Acts Referred to

Central Bank Act 1942 (No. 22)

Civil Liability Act 1961 (No. 41)

Civil Liability and Courts Act 2004 (No. 31)

Civil Partnership and Certain Rights and Obligations of Cohabitants Act 2010 (No. 24)

Companies Act 2014 (No. 38)

Courts of Justice Acts 1924 to 2014

Criminal Justice (Spent Convictions and Certain Disclosures) Act 2016 (No. 4)

Data Protection Acts 1988 to 2018

Employment Equality Act 1998 (No. 21)

Financial Services and Pensions Ombudsman Act 2017 (No. 22)

Health Insurance Act 1994 (No. 16)

Life Assurance Act 1774 (14 Geo 3, c. 48)

Life Insurance (Ireland) Act 1866 (29 & 30 Vict., c. 42)

Marine Insurance Act 1906 (8 Edw. 7 c. 41)

Number 53 of 2019

CONSUMER INSURANCE CONTRACTS ACT 2019

REVISED

Updated to 1 January 2023

An Act to reform the law of consumer insurance contracts and to provide for related matters.

[26th December, 2019]

Be it enacted by the Oireachtas as follows:

Section 1

Section 1

Interpretation

1. In this Act—

“average consumer” has the meaning given to it by Directive No. 2005/29/EC of the European Parliament and of the Council of 11 May 20051 concerning unfair business-to-consumer commercial practices in the internal market and amending Council Directive 84/450/EEC, Directives 97/7/EC, 98/27/EC and 2002/65/EC of the European Parliament and of the Council and Regulation (EC) No. 2006/2004 of the European Parliament and of the Council;

“consumer” has the meaning given to it by paragraph (a) of the definition of that expression (as it is defined in relation to a financial service) in section 2(1) of the Financial Services and Pensions Ombudsman Act 2017 but, for the purposes of this Act, that paragraph (a) shall apply as if references in it to “financial service” and “financial service provider” were construed, respectively, as references to “consumer insurance contract” and “insurer” within the meaning of this Act;

“continuing restrictive condition” means any condition, however expressed, that purports to require a consumer to do, or not to do, a particular act or acts, or requires him or her to act, or not to act, in a particular manner (and any condition the effect of which is that a given set of circumstances is required to exist or to be maintained or not to exist shall be taken as falling within this definition);

“contract of insurance” means, except where otherwise provided in this Act, a contract of life insurance or non-life insurance made between an insurer and a consumer;

“durable medium” means any instrument that enables a recipient to store information addressed personally to the recipient in a way that renders it accessible for future reference for a period of time adequate for the purposes of the information and which allows the unchanged reproduction of the information stored;

“fraudulent misrepresentation” means a misrepresentation that is false or misleading in any material respect and which the consumer either—

(a) knows to be false or misleading, or

(b) consciously disregards whether it is false or misleading, and “fraudulent” or “fraud” shall be construed accordingly;

“insurance intermediary” has the meaning given to it by Regulation 2 of the European Union (Insurance Distribution) Regulations 2018 (S.I. No. 229 of 2018);

“insurer” means an insurance undertaking, that is to say, an insurance undertaking within the meaning of, as appropriate, Regulation 3 of the European Union (Insurance and Reinsurance) Regulations 2015 (S.I. No. 485 of 2015), Regulation 2 of the European Communities (Non-Life Insurance) Framework Regulations 1994 (S.I. No. 359 of 1994) or Regulation 2 of the European Communities (Life Assurance) Framework Regulations 1994 (S.I. No. 360 of 1994);

“life insurance” has the meaning given to it by Regulation 3 of the European Union (Insurance and Reinsurance) Regulations 2015 (S.I. No. 485 of 2015);

“Minister” means the Minister for Finance;

“non-life insurance” has the meaning given to it by Regulation 3 of the European Union (Insurance and Reinsurance) Regulations 2015 (S.I. No. 485 of 2015).

Section 2

Section 2

Scope of Act

2. (1) Except where otherwise provided, each provision of this Act applies to life and non-life contracts of insurance entered into, and variations to such contracts of insurance agreed, between an insurer and a consumer after the commencement of the provision concerned.

(2) This Act does not alter or affect any rights or obligations concerning or arising from—

(a) a contract of reinsurance,

(b) a contract of insurance that falls within class 1(d), 4, 5, 6, 7, 11 or 12 referred to in Schedule 1 to the European Union (Insurance and Reinsurance) Regulations 2015 (S.I. No. 485 of 2015),

(c) a contract of insurance involving a special purpose vehicle within the meaning of the European Union (Insurance and Reinsurance) Regulations 2015 (S.I. No. 485 of 2015), or

(d) the duties of the Motor Insurers’ Bureau of Ireland in the conduct of its activities in relation to sections 19 to 21.

(3) No provision of the Marine Insurance Act 1906 applies to a contract of insurance to which this Act applies.

(4) No provision of the Life Assurance Act 1774, as extended to Ireland by the Life Insurance (Ireland) Act 1866, applies to a contract of insurance to which this Act applies.

Section 3

Section 3

Amendment of Schedule 2 to Central Bank Act 1942

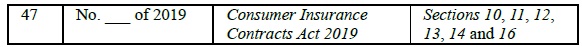

3. (1) The Central Bank Act 1942 is amended in Part 1 of Schedule 2 by the insertion of the following:

“

”.

(2) With respect to the amendment effected to the Central Bank Act 1942 by subsection (1), and that amendment only and so as not to affect the operation of the general law specified in subsection (3), where a reference occurs in any section of this Act, specified in that amendment, to “insurer”, that reference shall be construed, where an insurance intermediary is acting on behalf of an insurer, as including a reference to the insurance intermediary.

(3) The general law referred to in subsection (2) is the general law, as it applies to this Act, whereby an act or omission done or made by an agent, such as an insurance intermediary, on behalf of an insurer is regarded as an act or omission done or made by the insurer.

Section 4

Section 4

Amendment of section 60 of Financial Services and Pensions Ombudsman Act 2017

4. Section 60 of the Financial Services and Pensions Ombudsman Act 2017 is amended by the insertion of the following subsections after subsection (4):

“(4A) (a) In paragraph (b) and subsections (4B) and (4C) “Act of 2019” means the Consumer Insurance Contracts Act 2019.

(b) Subsection (4B) is without prejudice to the generality of subsection (2) as it operates to enable the Ombudsman to make decisions by reference to, amongst other things, the enactments concerning the financial service concerned, including, as the case may be, the Act of 2019.

(4B) The provisions of section 26 of the Act of 2019 apply in relation to the power of the Ombudsman under subsection (4)(d) to direct the payment of compensation in a complaint involving a contract of insurance as they apply in relation to the power of a court of competent jurisdiction to make an award of damages in a claim under a contract of insurance.

(4C) The power under section 26 of the Act of 2019 shall not be exercised by the Ombudsman to an extent that such exercise would have the result that the total sum of compensation payable in respect of the complaint concerned exceeds the amount which, by way of compensation, the Ombudsman has jurisdiction to direct the payment of under this Act.”.

Section 5

Section 5

Regulations and codes of practice

5. The Central Bank of Ireland may issue a code of practice concerning the form of, a contract of insurance or any other requirements related to such a contract contained in this Act.

Section 6

Section 6

Effect of codes of practice

6. A code of practice, made under any enactment or instrument under an enactment, which contains practical guidance that would assist a court or other adjudicatory body such as the Financial Services and Pensions Ombudsman in determining any issue before it in connection with a consumer insurance contract to which this Act applies, shall be admissible for that purpose and may be taken into account.

Section 7

Section 7

Insurable interest

7. (1) A claim by a consumer under an otherwise valid contract of insurance shall not be rejected by the insurer by reason only that the consumer does not have, or did not have at the time when the contract was entered into, an interest in the subject-matter of the contract.

(2) Where the consumer is required, because the contract of insurance is also a contract of indemnity, to have an interest in the subject-matter of the contract, the interest required shall not extend beyond a factual expectation either of an economic benefit from the preservation of the subject matter, or of an economic loss on its destruction, damage or loss that would arise in the ordinary course of events.

(3) An insurer is not relieved of liability under the contract of insurance by reason only that the name of the person who may benefit under the contract is not specified in a policy document.

Section 8

Section 8

Pre-contractual duties of consumer and insurer

8. (1) The duties in this section replace, at the pre-contractual stage of a contract of insurance, the principle of utmost good faith (uberrima fides) and any duty of disclosure of a consumer (including any duty on the consumer to volunteer information) that applied prior to the commencement of this section (whether that principle or duty arose at common law or under an enactment).

(2) The pre-contractual duty of disclosure of a consumer is confined to providing responses to questions asked by the insurer, and the consumer shall not be under any duty to volunteer any information over and above that required by such questions.

(3) Where the insurer requests the consumer at the pre-contractual stage to provide information to the insurer, the insurer shall be under a duty to ask specific questions, on paper or on another durable medium, and shall not use general questions.

(4) It shall be presumed, unless the contrary is shown, that the consumer knows that a matter about which the insurer asks a specific question is material to the risk undertaken by that insurer or the calculation of the premium by that insurer, or both.

(5) (a) Where the insurer asks questions these shall be drafted in plain and intelligible language, and the onus of proving that the questions are plain and intelligible shall rest with the insurer.

(b) Where there is an ambiguity or a doubt about the meaning of a question the interpretation most favourable to the consumer shall prevail.

(6) An insurer may use the remedies available under this Act (including the remedy to repudiate liability or to limit the amount paid on foot of the contract of insurance) only if it establishes that non-disclosure of material information was an effective cause of the insurer entering into the relevant contract of insurance and on the terms on which it did.

(7) (a) The consumer shall be under a duty to answer all questions posed by the insurer honestly and with reasonable care (the test of reasonable care being by reference to that of the average consumer).

(b) In determining whether the consumer has complied with this duty, regard shall be had to, amongst other matters, the following:

(i) the type of insurance contract in question and its target market;

(ii) any relevant explanatory material or publicity produced or authorised by the insurer;

(iii) how clear and specific are the insurer’s questions;

(iv) whether the consumer is represented by an agent and the circumstances of that representation; and

(v) that some consumers can be expected to be in possession of more information than others.

(8) The test of what is material, and consequently the scope of questions that the insurer may ask the consumer, are without prejudice to—

(a) the requirements of the Data Protection Acts 1988 to 2018, and

(b) the provisions of the Criminal Justice (Spent Convictions and Certain Disclosures) Act 2016.

(9) Every insurer shall, before a contract of insurance is entered into, or renewed, inform the consumer on paper or on another durable medium of the general nature and effect of the pre-contractual duty of disclosure.

(10) (a) An insurer shall be deemed to have waived any further duty of disclosure of the consumer where it fails to investigate an absent or obviously incomplete answer to a question.

(b) The waiver in paragraph (a) does not apply where the non-disclosure arises from fraudulent, intentional or reckless concealment.

Section 9

Section 9

Proportionate remedies for misrepresentation

9. (1) This section provides for remedies that are proportionate to the effects of any misrepresentation on the interests of the insurer and the consumer by reference as to whether the misrepresentation was—

(a) innocent (that is, one that was neither negligent nor fraudulent),

(b) negligent, or

(c) fraudulent.

(2) Where a claim is made under a contract of insurance and where the consumer has discharged the duty under section 8 to answer questions honestly and with reasonable care but where an answer involves an innocent misrepresentation, the insurer shall be required to pay the claim made and shall not be entitled to avoid the contract on the ground that there was a misrepresentation.

(3) Where a claim is made under a contract of insurance and where the consumer has discharged the duty under section 8 to answer questions honestly and with reasonable care but where an answer involves a negligent misrepresentation (that is, one that was not fraudulent), the remedy available to the insurer shall reflect what the insurer would have done had it been aware of the full facts and shall be based on a compensatory and proportionate test.

(4) Without prejudice to the generality of subsection (3), where an answer given by the consumer involves a negligent misrepresentation—

(a) if the insurer would not have entered into the insurance contract on any terms, the insurer may avoid the contract and refuse all claims, but shall return the premiums paid,

(b) if the insurer would have entered into the insurance contract, but on different terms (excluding terms relating to the premium), the contract is to be treated as if it had been entered into on those different terms if the insurer so requires,

(c) if the insurer would have entered into the insurance contract (whether the terms relating to matters other than the premium would have been the same or different), but would have charged a higher premium, the insurer may reduce proportionately the amount to be paid on a claim,

(d) where there is not any outstanding claim under the insurance contract, the insurer may either—

(i) give notice to the consumer that in the event of a claim it will exercise the remedies in paragraphs (a) to (c), or

(ii) in the case of a non-life insurance contract only, terminate the contract by giving reasonable notice to the consumer.

(5) Where a claim is made under a contract of insurance and where an answer by the consumer involves a fraudulent misrepresentation or where any conduct by the consumer (relative to the contract or the steps leading to its formation) involves fraud of any other kind, the insurer shall be entitled to avoid the contract of insurance.

Section 10

Section 10

Provision of information relevant to contract of insurance and interpretation of certain terms

10. (1) Within a reasonable time after concluding a contract of insurance, the insurer shall, where such is relevant to the particular contract, provide the consumer on paper or another durable medium with the completed application or proposal form.

(2) Where there is an ambiguity or doubt about the meaning of a term in any document referred to in subsection (1), the rule of law applicable to contracts of insurance, namely that the interpretation most favourable to the consumer, or beneficiary, as appropriate, shall prevail, applies.

Annotations

Modifications (not altering text):

C1

Reference to "insurer" construed in limited circumstances (8.07.2022) by Insurance (Miscellaneous Provisions) Act 2022 (11/2022), s. 10(2), S.I. No. 346 of 2022, art. 3.

Amendment of Central Bank Act 1942

10. ...

(2) With respect to the amendment effected to the Central Bank Act 1942 by subsection (1), and that amendment only and so as not to affect the operation of the general law specified in subsection (3), where a reference occurs in section 10, 11, 12, 13, 14, 16, 16A or 16B of the Act of 2019 to “insurer”, that reference shall be construed, where an insurance intermediary is acting on behalf of an insurer, as including a reference to the insurance intermediary.

(3) The general law referred to in subsection (2) is the general law whereby an act or omission done or made by an agent, such as an insurance intermediary, on behalf of an insurer is regarded as an act or omission done or made by the insurer.

...

Section 11

Section 11

Right to withdraw from contract of insurance by notice: cooling-off period

11. (1) Subject to subsection (3), in a case in which the consumer’s entitlement to cancel a contract of insurance is not governed by the European Union (Insurance and Reinsurance) Regulations 2015 (S.I. No. 485 of 2015) or the European Communities (Distance Marketing of Consumer Financial Services) Regulations 2004 (S.I. No. 853 of 2004), a consumer may cancel a contract of insurance, by giving notice in writing of cancellation to the insurer, within 14 working days after the date when the consumer is informed that the contract has been concluded.

(2) The giving of notice of cancellation by a person shall have the effect of releasing the person from any further obligation arising from the contract.

(3) The right to cancel a contract of insurance under subsection (1) does not apply where the duration of the contract is less than one month.

(4) Where the consumer cancels the contract of insurance under subsection (1), the insurer shall not impose any financial cost on the consumer other than the cost of the premium for the period of cover.

Annotations

C2

Reference to "insurer" construed in limited circumstances (8.07.2022) by Insurance (Miscellaneous Provisions) Act 2022 (11/2022), s. 10(2), S.I. No. 346 of 2022, art. 3.

Amendment of Central Bank Act 1942

10. ...

(2) With respect to the amendment effected to the Central Bank Act 1942 by subsection (1), and that amendment only and so as not to affect the operation of the general law specified in subsection (3), where a reference occurs in section 10, 11, 12, 13, 14, 16, 16A or 16B of the Act of 2019 to “insurer”, that reference shall be construed, where an insurance intermediary is acting on behalf of an insurer, as including a reference to the insurance intermediary.

(3) The general law referred to in subsection (2) is the general law whereby an act or omission done or made by an agent, such as an insurance intermediary, on behalf of an insurer is regarded as an act or omission done or made by the insurer.

...

Section 12

Section 12

Renewal of contract of insurance

12. (1) In the case of a contract of non-life insurance, the insurer, when issuing a renewal notice to a consumer, shall provide the consumer with a schedule outlining the following:

(a) any premiums paid by the consumer to the insurer in the preceding five years on foot of the contract, and

(b) a list of any claims, including if such have been made, third party claims, that have been paid, on foot of the contract, by the insurer to the consumer (or, as the case may be, to the third party or parties concerned) in the preceding 5 years, except, where the contract concerned is a health insurance contract in within the meaning of section 2(1) of the Health Insurance Act 1994.

(2) Where there has been any mid-term adjustment made to the contract in any of the previous five years, the information to be provided for the purposes of subsection (1)(a) shall be met by:

(a) the provision of an annualised premium figure for the relevant year or years excluding fees or charges applied as a result of that adjustment, and

(b) a statement indicating that the annualised premium figure shown may not reflect the actual premium paid in the relevant year or years.

(3) In subsection (2) the reference to any mid-term adjustment made to the contract is a reference to any alteration lawfully made to the provisions of the contract, at any time during its currency, that results in a change in the amount of the premium charged or in the application of any fee or other charge.

Annotations

C3

Reference to "insurer" construed in limited circumstances (8.07.2022) by Insurance (Miscellaneous Provisions) Act 2022 (11/2022), s. 10(2), S.I. No. 346 of 2022, art. 3.

Amendment of Central Bank Act 1942

10. ...

(2) With respect to the amendment effected to the Central Bank Act 1942 by subsection (1), and that amendment only and so as not to affect the operation of the general law specified in subsection (3), where a reference occurs in section 10, 11, 12, 13, 14, 16, 16A or 16B of the Act of 2019 to “insurer”, that reference shall be construed, where an insurance intermediary is acting on behalf of an insurer, as including a reference to the insurance intermediary.

(3) The general law referred to in subsection (2) is the general law whereby an act or omission done or made by an agent, such as an insurance intermediary, on behalf of an insurer is regarded as an act or omission done or made by the insurer.

...

Section 13

Section 13

Cancellation of contract of insurance

13. (1) Where, in accordance with the contract, an insurer notifies a consumer that the insurer is cancelling a contract of insurance, the insurer shall repay to the consumer the balance of the premium for the unexpired term of the contract and provide to the consumer the reason or reasons for the cancellation.

(2) The insurer shall not impose any financial cost on the consumer where, in accordance with this section, a contract of insurance is cancelled.

Annotations

Modifications (not altering text):

C4

Reference to "insurer" construed in limited circumstances (8.07.2022) by Insurance (Miscellaneous Provisions) Act 2022 (11/2022), s. 10(2), S.I. No. 346 of 2022, art. 3.

Amendment of Central Bank Act 1942

10. ...

(2) With respect to the amendment effected to the Central Bank Act 1942 by subsection (1), and that amendment only and so as not to affect the operation of the general law specified in subsection (3), where a reference occurs in section 10, 11, 12, 13, 14, 16, 16A or 16B of the Act of 2019 to “insurer”, that reference shall be construed, where an insurance intermediary is acting on behalf of an insurer, as including a reference to the insurance intermediary.

(3) The general law referred to in subsection (2) is the general law whereby an act or omission done or made by an agent, such as an insurance intermediary, on behalf of an insurer is regarded as an act or omission done or made by the insurer.

...

Section 14

Section 14

Duties of consumer and insurer at renewal

14. (1) The duty of disclosure in section 8 shall not be taken to imply that a consumer who has on a previous occasion discharged that duty of disclosure is under an obligation at renewal of the contract of insurance to provide the insurer with any additional information, whether concerning matters that have changed or otherwise, unless the insurer has expressly required the consumer to do so in accordance with subsection (2).

(2) Where an insurer intends that the consumer is to provide additional information at renewal concerning a particular matter, it shall either—

(a) ask the consumer a specific question on paper or on another durable medium regarding the matter, or

(b) request the consumer on paper or on another durable medium to update information previously provided concerning that matter, which the insurer shall specifically describe and shall provide to the consumer a written copy of the matter previously disclosed.

(3) Where the insurer requests the consumer at renewal to provide information to the insurer, the insurer shall be under a duty to ask specific questions, on paper or on another durable medium, and shall not use general questions.

(4) The consumer shall be under a duty to respond honestly and with reasonable care, (which has the same meaning as in section 8), to any requests by the insurer at the renewal of the contract of insurance and, if the consumer does not provide any new information in response to the insurer’s request and where the consumer continues to pay the renewal premium, it shall be presumed that the information previously provided has not altered.

(5) The renewal by the insurer of the contract of insurance shall not, in itself, be taken to remedy any previous breach of any duty of disclosure arising under this Act.

(6) The insurer shall, within a reasonable time before renewal of a contract of insurance (and in any event no later than 20 working days before renewal), notify the consumer on paper or on another durable medium of any alteration to the terms and conditions of the policy, using plain intelligible language in doing so.

Annotations

Modifications (not altering text):

C5

Reference to "insurer" construed in limited circumstances (8.07.2022) by Insurance (Miscellaneous Provisions) Act 2022 (11/2022), s. 10(2), S.I. No. 346 of 2022, art. 3.

Amendment of Central Bank Act 1942

10. ...

(2) With respect to the amendment effected to the Central Bank Act 1942 by subsection (1), and that amendment only and so as not to affect the operation of the general law specified in subsection (3), where a reference occurs in section 10, 11, 12, 13, 14, 16, 16A or 16B of the Act of 2019 to “insurer”, that reference shall be construed, where an insurance intermediary is acting on behalf of an insurer, as including a reference to the insurance intermediary.

(3) The general law referred to in subsection (2) is the general law whereby an act or omission done or made by an agent, such as an insurance intermediary, on behalf of an insurer is regarded as an act or omission done or made by the insurer.

...

Section 15

Section 15

Post-contractual duties of consumer and insurer

15. (1) The duties in this section replace, at all stages subsequent to the entering into of the contract of insurance, the principle of utmost good faith (uberrima fides) that applied prior to the coming into force of this section (whether that principle arose at common law or under an enactment).

(2) A consumer shall be under a duty to pay the premium within a reasonable time, or in accordance with the terms of the contract, provided those terms comply with the requirements of section 20.

(3) An insurer may refuse a claim made by a consumer under a contract of insurance where there is a change in the subject matter of the contract of insurance, including as described in an “alteration of risk” clause, and circumstances have so changed that it can properly be said by the insurer that the new risk is something which, on the true construction of the policy, it did not agree to cover.

(4) (a) An “alteration of risk” clause in a contract of insurance shall apply only in circumstances where the subject matter of the contract of insurance has altered.

(b) An “alteration of risk” clause shall be void where it purports to apply where there is a modification only of the risk insured.

(5) Any clause in a contract of insurance that refers to a “material change” shall be interpreted as referring to changes that take the risk outside that which was within the reasonable contemplation of the contracting parties when the contract of insurance was concluded.

(6) An insurer who intends to exclude certain matters from coverage under the contract of insurance shall do so explicitly in writing prior to the commencement of the contract.

Section 16

Section 16

Claims handling: duties of consumer and insurer

16. (1) The consumer shall cooperate with the insurer in the investigation of insured events, including by responding to reasonable requests for information in an honest and reasonably careful manner.

(2) The consumer shall notify the insurer of the occurrence of an insured event within a reasonable time or in accordance with the terms of the contract, provided those terms comply with the requirements of section 20.

(3) Where non-compliance by the consumer with a specified notification period does not prejudice the insurer, the insurer shall not be entitled to refuse liability under the claim on that ground alone.

(4) Without prejudice to any other duties in this section and to an insurer’s right to make the final determination in relation to a claim, the insurer shall be under a duty to—

(a) handle promptly and fairly any claim made in relation to the contract of insurance (a “claim”),

(b) where it is not made by the consumer himself or herself, notify a consumer of a claim as soon as practicable after the insurer is informed of the claim,

(c) engage with the consumer as regards a claim, and such engagement shall include providing an opportunity to the consumer to submit to the insurer relevant evidence which could inform the insurer’s determination as regards the claim,

(d) where a claim has been settled or otherwise disposed of, inform the consumer of the amount for which it has been settled or otherwise disposed of and the reason or reasons for its being settled or so disposed of.

(5) A reference in subsection (4)(d) to a claim being otherwise disposed of includes a reference to a claim being disposed of by reason of liability, against the insurer, being established in legal or arbitral proceedings in respect of the matter or matters concerned but where the claim is disposed of in that manner the duty under subsection (4)(d) to inform the consumer of the reason for its being so disposed of may be discharged by referring the consumer to the judgment or arbitral award concerned.

(6) In relation to any claim made in relation to a contract of insurance (whether by the consumer or a third party), an insurer shall not, for the purpose referred to in subsection (7), fail to engage in a meaningful manner with the consumer or third party as respects correspondence on the matter (with the insurer) of the consumer or third party.

(7) The purpose referred to in subsection (6) is to dissuade the consumer or third party from exercising contractual rights in respect of the claim.

(8) The insurer shall pay any sums due to the consumer in respect of the claim within a reasonable time.

(9) Where it is not possible to quantify the total value of the claim within a reasonable time but where part of the total value has been quantified, the insurer shall pay that part to the consumer within a reasonable time.

(10) F1[…]

Annotations

Amendments:

F1

Deleted (1.10.2022) by Insurance (Miscellaneous Provisions) Act 2022 (11/2022), s. 7, S.I. No. 346 of 2022, art. 4(a).

Modifications (not altering text):

C6

Reference to "insurer" construed in limited circumstances (8.07.2022) by Insurance (Miscellaneous Provisions) Act 2022 (11/2022), s. 10(2), S.I. No. 346 of 2022, art. 3.

Amendment of Central Bank Act 1942

10. ...

(2) With respect to the amendment effected to the Central Bank Act 1942 by subsection (1), and that amendment only and so as not to affect the operation of the general law specified in subsection (3), where a reference occurs in section 10, 11, 12, 13, 14, 16, 16A or 16B of the Act of 2019 to “insurer”, that reference shall be construed, where an insurance intermediary is acting on behalf of an insurer, as including a reference to the insurance intermediary.

(3) The general law referred to in subsection (2) is the general law whereby an act or omission done or made by an agent, such as an insurance intermediary, on behalf of an insurer is regarded as an act or omission done or made by the insurer.

...

Section 16A

Section 16A

F2[Mutual duties of disclosure in claims handling

16A. (1) Where, after a claim has been made by a consumer, the consumer or the insurer concerned becomes aware of information (including non‑factual information) that would either support or prejudice the validity of the claim—

(a) in a case in which the consumer has become aware of the information, the consumer shall disclose the information to the insurer, and

(b) in a case in which the insurer has become aware of the information, the insurer shall disclose the information to the consumer.

(2) Where the information referred to in subsection (1) is contained in a report prepared for the purposes of pending or contemplated civil proceedings—

(a) that subsection shall apply notwithstanding any enactment or rule of law by virtue of which the report would otherwise be subject to litigation privilege, and

(b) the consumer or insurer, as the case may be, in receipt of the report shall disclose the report within 60 days from the date of receipt.

(3) This section shall not affect the operation of any enactment or rule of law by virtue of which—

(a) a report prepared by a lawyer, or

(b) a communication between a lawyer and another person,

is privileged.

(4) In this section—

"claim" means a claim made under a contract of insurance;

"report" means a report, letter or statement—

(a) in draft or final form,

(b) in physical or electronic form,

(c) prepared by an accountant, actuary, architect, dentist, doctor, engineer, occupational therapist, psychologist, psychiatrist, scientist or other expert,

(d) which—

(i) has been procured by or on behalf of a consumer or insurer for the purposes of assessing the validity of a claim, or

(ii) contains information which either supports or prejudices a claim,

and

(e) which has been received by the consumer or insurer concerned,

and includes any maps, drawings, photographs, graphs, charts, calculations or other like matter referred to in any such report, letter or statement.]

Annotations

Amendments:

F2

Inserted (1.10.2022) by Insurance (Miscellaneous Provisions) Act 2022 (11/2022), s. 8, S.I. No. 346 of 2022, art. 4(b).

Modifications (not altering text):

C7

Reference to "insurer" construed in limited circumstances (8.07.2022) by Insurance (Miscellaneous Provisions) Act 2022 (11/2022), s. 10(2), S.I. No. 346 of 2022, art. 3.

Amendment of Central Bank Act 1942

10. ...

(2) With respect to the amendment effected to the Central Bank Act 1942 by subsection (1), and that amendment only and so as not to affect the operation of the general law specified in subsection (3), where a reference occurs in section 10, 11, 12, 13, 14, 16, 16A or 16B of the Act of 2019 to “insurer”, that reference shall be construed, where an insurance intermediary is acting on behalf of an insurer, as including a reference to the insurance intermediary.

(3) The general law referred to in subsection (2) is the general law whereby an act or omission done or made by an agent, such as an insurance intermediary, on behalf of an insurer is regarded as an act or omission done or made by the insurer.

...

Section 16B

Section 16B

F2[Disclosure of deductions from claim settlement

16B. (1) Where an insurer has deducted from a claim settlement any amount, including where the deduction is in respect of amounts paid out of public moneys to a claimant (other than deductions in respect of payments in relation to which a corresponding amount has been paid to the Minister for Social Protection in accordance with Part 11B of the Social Welfare Consolidation Act 2005), the insurer shall notify the claimant that an amount has been so deducted.

(2) The notification referred to in subsection (1) shall—

(a) specify the amount of the deduction,

(b) specify the reason why that amount has been deducted from the claim settlement, and

(c) be provided to the claimant on paper or another durable medium.

(3) In this section—

"claimant" means a consumer who has made a claim under a relevant contract of insurance;

"claim settlement" means the amount payable to a claimant in respect of a claim under a relevant contract of insurance, before any deduction, whether in accordance with that contract or otherwise, is made by the insurer;

"public moneys" means moneys charged on or issued out of the Central Fund or the growing produce thereof or provided by the Oireachtas;

"relevant contract of insurance" means a contract of insurance in respect of non-life insurance.]

Annotations

Amendments:

F3

Inserted (1.01.2023) by Insurance (Miscellaneous Provisions) Act 2022 (11/2022), s. 8, S.I. No. 346 of 2022, art. 5.

Modifications (not altering text):

C8

Reference to "insurer" construed in limited circumstances (8.07.2022) by Insurance (Miscellaneous Provisions) Act 2022 (11/2022), s. 10(2), S.I. No. 346 of 2022, art. 3.

Amendment of Central Bank Act 1942

10. ...

(2) With respect to the amendment effected to the Central Bank Act 1942 by subsection (1), and that amendment only and so as not to affect the operation of the general law specified in subsection (3), where a reference occurs in section 10, 11, 12, 13, 14, 16, 16A or 16B of the Act of 2019 to “insurer”, that reference shall be construed, where an insurance intermediary is acting on behalf of an insurer, as including a reference to the insurance intermediary.

(3) The general law referred to in subsection (2) is the general law whereby an act or omission done or made by an agent, such as an insurance intermediary, on behalf of an insurer is regarded as an act or omission done or made by the insurer.

...

Section 17

Section 17

Limitations on deferring payment of claim until completion of works, etc., in case of property contracts

17. (1) In this section—

“claim settlement amount” means, in respect of a relevant claim—

(a) unless paragraph (b) applies, the amount that is payable under the relevant contract of insurance to the consumer in respect of damage to property, the subject of the claim, or

(b) an amount in respect of such damage that the insurer states to the consumer that—

(i) the insurer is willing to pay to the consumer, based on an estimate of the cost of the repair, replacement or re-instatement work involved, and

(ii) the payment of which (if the consumer agrees to such) will constitute the discharge of the insurer’s liability under the contract in respect of the claim;

“relevant claim” means a claim under a relevant contract of insurance in respect of damage to property covered by the contract;

“relevant contract of insurance” means a contract of insurance that provides insurance in respect of damage to property (whether in addition to other matters or not).

(2) This section applies to any provision of a relevant contract of insurance under which the insurer, in respect of a claim settlement amount, is not obliged to pay the full amount thereof unless and until the following conditions are satisfied, namely, the repair, replacement or re-instatement work involved has been completed and specified documentation, in respect of such work, has been furnished to the insurer.

(3) In relation to a provision to which this section applies—

(a) the provision shall be void unless, prior to the commencement of the relevant contract of insurance, the provision is brought to the consumer’s notice, on paper or on another durable medium, and in terms that are clear and unambiguous,

(b) notwithstanding that paragraph (a) is complied with but without prejudice to paragraph (c), the insurer shall not invoke the provision in respect of a relevant claim unless, at the time of the making of the claim, the provision is brought to the consumer’s notice on paper or on another durable medium, and

(c) the provision shall be construed and shall operate as being subject to the following limitation, namely, the amount of the claim settlement amount, payment of which may be deferred to the time the conditions referred to in subsection (2) are satisfied, shall not exceed—

(i) 5 per cent of the claim settlement amount - in a case in which the claim settlement amount is less than €40,000,

(ii) 10 per cent of the claim settlement amount - in a case in which the claim settlement amount is €40,000 or more.

Section 18

Section 18

Proportionate remedies and claims handling

18. (1) Where a claim made by a consumer under a contract of insurance contains information that is false or misleading in any material respect and which the consumer either knows to be false or misleading or consciously disregards whether it is false or misleading, the insurer shall be entitled to refuse to pay the claim and shall be entitled to terminate the contract.

(2) A valid claim made under a policy is not affected where, under the same policy, the consumer makes a subsequent fraudulent claim or where fraudulent evidence or information is submitted or adduced in its support.

(3) Where an insurer becomes aware that a consumer has made a fraudulent claim, the insurer may, as soon as is practicable after becoming aware of that fact, notify the consumer on paper or on another durable medium that it is avoiding the insurance contract, and if the insurer so notifies the consumer, the insurance contract shall be treated as having been terminated with effect from the date of the submission of the fraudulent claim (referred to in this subsection as “the date of the fraudulent act”), whereupon—

(a) the insurer may refuse all liability to the consumer under the insurance contract in respect of any claim made after the date of the fraudulent act, and

(b) the insurer need not return any of the premiums paid under the insurance contract.

(4) F4[(a) Where a contract of insurance, under which 2 or more consumers are co-insureds, contains a term or condition excluding coverage for loss or damage to property caused by a criminal or intentional act or omission of a co-insured, the exclusion shall apply only to the claim of a consumer—

(i) whose act or omission caused the loss or damage,

(ii) who abetted or colluded in the act or omission, or

(iii) who consented to the act or omission and knew or ought to have known that the act or omission would cause the loss or damage.]

F4[(b) Nothing in paragraph (a) shall be interpreted as—

(i) allowing a person whose property is insured under the contract of insurance to recover more than that person’s proportionate interest in the lost or damaged property, or

(ii) affecting the operation of a term or condition in the contract of insurance excluding coverage for loss or damage to property caused by war, an act of terrorism, a nuclear attack or a cyberattack.]

(c) A consumer whose coverage under the contract of insurance would be excluded but for paragraph (a) shall cooperate with the insurer in respect of the investigation of the loss, including—

(i) by submitting a statutory declaration if requested by the insurer, and

(ii) by producing for examination at a reasonable time and place designated by the insurer documents specified by the insurer that relate to the loss.

F5[(d) For the purposes of paragraph (a), 2 or more consumers are each a co-insured under a contract of insurance where each of those consumers—

(i) has an interest in the insured property, and

(ii) is insured against loss or damage to the insured property.]

(5) An insurer shall not be entitled to claim against the consumer the cost of investigating a fraudulent claim.

Annotations

Amendments:

F4

Substituted (8.07.2022) by Insurance (Miscellaneous Provisions) Act 2022 (11/2022), s. 9(a), (b), S.I. No. 346 2022, art. 3.

F5

Inserted (8.07.2022) by Insurance (Miscellaneous Provisions) Act 2022 (11/2022), s. 9(c), S.I. No. 346 of 2022, art. 3.

Section 19

Section 19

Representations by consumer and terms that reduce the risk being underwritten (replacing insurance warranties)

19. (1) The provisions in this section replace, in a contract of insurance, the law concerning insurance warranties that applied prior to the commencement of this section (whether that law arose at common law or under an enactment).

(2) Any statement made by a consumer in or in connection with a contract of insurance, being a statement made by or attributable to a consumer with respect to the existence of a state of affairs or a statement of opinion, shall have effect solely as a representation made by the consumer to the insurer prior to entering into the contract.

(3) Any term in a contract of insurance which purports to convert any statement referred to in subsection (2) into a warranty (as understood in the law concerning insurance warranties prior to the commencement of this section), including by means of a declared “basis of contract” clause or by any comparable clause (including one described as a warranty, a future warranty, a promissory warranty or a continuing warranty), shall be invalid.

(4) In contract of insurance, any contract term however described that imposes a continuing restrictive condition on the consumer during the course of the contract shall be treated as a suspensive condition in that, upon a breach of such a condition, the insurer’s liability is, subject to subsection (5), suspended for the duration of the breach but if the breach has been remedied by the time a loss has occurred, the insurer shall (in the absence of any other defence to the claim) be obliged to pay any claim made under the contract of insurance.

(5) Subsection (4) does not suspend the liability of the insurer if the fact that the breach referred to in that subsection has occurred has not increased, in the circumstances concerned, the risk of a loss that has occurred (being a loss for which liability on the part of the insurer is claimed by the consumer).

(6) (a) This subsection applies to any term in a contract of insurance however described that has the effect of reducing the risk underwritten by the insurer related to—

(i) a particular type of loss,

(ii) loss at a particular time, or

(iii) loss in a particular location.

(b) Without prejudice to the generality of subsection (4), any breach by the consumer of the type of contract term referred to in paragraph (a) shall only suspend the liability of the insurer in respect of that particular type of loss, or loss at a particular time or loss in a particular location, as the case may be, and if the breach has been remedied by the time a loss has occurred, the insurer shall (in the absence of any other defence to the claim) be obliged to pay any claim made under the contract of insurance.

Section 20

Section 20

Unfair or onerous terms

20. In addition to applying to a “consumer” as defined in those Regulations, the European Communities (Unfair Terms in Consumer Contracts) Regulations 1995 (S.I. No. 27 of 1995) shall apply to a consumer within the meaning of this Act.

Section 21

Section 21

Right of third party to claim against insurer

21. (1) Where a person (in this section referred to as “the person”) is insured under a contract of insurance against a liability that may be incurred by the person to a third party (and such a liability is incurred) then, where either of the following applies—

(a) the person has died, or cannot be found, or is insolvent, or

(b) for any other reason it appears to a court to be just and equitable to so order,

the rights of the person under the contract against the insurer in respect of the liability shall, notwithstanding anything in any enactment or rule of law, be transferred to and vest in the third party to whom the liability was so incurred.

(2) Accordingly, a third party, in the circumstances described in subsection (1), has a right to recover from the insurer, in accordance with the contract of insurance, the amount of any loss suffered by the third party even though the third party is not a party to the contract of insurance.

(3) Where a third party reasonably believes that the person has incurred a liability to which this section applies, the third party shall be entitled, by way of notice on paper or on another durable medium, to seek and obtain information from the insurer or from any other person who is able to provide it (neither of whom shall unreasonably refuse such information) concerning—

(a) the existence of a contract of insurance that covers the supposed liability or which might be regarded as covering it,

(b) if there exists such a contract, who the insurer is,

(c) the terms of the contract, and

(d) whether the insurer has informed the person that the insurer intends to refuse liability under the contract in respect of the person’s supposed liability.

(4) A third party shall be entitled to issue proceedings directly against the insurer to enforce the terms of the contract of insurance without having first established the liability of the person, but before the terms of the contract can be enforced against the insurer in the proceedings the third party shall be required to establish the person’s liability.

(5) For the purposes of this section, a liability is established only if its existence and amount are established and, for that purpose, “establish” means establish—

(a) by virtue of a declaration under section 22,

(b) by judgment or decree,

(c) by an award in arbitral proceedings, or

(d) by an enforceable agreement.

(6) (a) Where a third party proceeds directly against an insurer, anything done by the third party which, if done by the person, would have amounted to or contributed to fulfilment of a condition of the insurance contract is to be treated as if done by the person.

(b) Without prejudice to paragraph (a), the third party has, in relation to the third party’s claim, the same obligations to the insurer as the third party would have if the third party were the person, and may discharge the person’s obligations in relation to the loss.

(c) The insurer has the same defences to an action brought by the third party as the insurer would have in an action by the person.

(d) Without prejudice to paragraph (c), the insurer shall be entitled to set off any liabilities incurred by the person in favour of the insurer against any liability owed by the insurer to the third party.

(7) The rights of a third party in this section shall not be subject to a term in a contract of insurance that requires the person to provide information or assistance to the insurer if that term cannot be fulfilled because the person is an individual who has died or cannot be found; but “term that requires the insured person to provide information or assistance to the insurer” shall not include a term that requires the person to notify the insurer of the existence of a claim under the contract of insurance.

(8) The rights of a third party in this section shall not be subject to a term in a contract of insurance that requires the prior discharge by the person of the person’s liability to a third party.

(9) Nothing in this section shall be interpreted as requiring that the third party be in existence either at the time the contract of insurance was entered into or at the time of assent to such a contract by another third party.

(10) In this section, “cannot be found” —

(a) means, in the case of an individual, a missing person, that is, a person who is observed to be missing from his or her normal patterns of life, where those who are likely to have heard from the missing person are unaware of his or her whereabouts and where the circumstances of the person being missing raise concerns for the person’s safety and well-being, and

(b) includes, in the case of a company, an insolvent company, and where such a company has been struck off the register of companies the third party shall (subject to the other requirements of this section) not be required to restore it to the register before proceeding directly against the insurer.

(11) In the case of an insolvency, moneys that would otherwise be payable to the person under the contract of insurance shall be applicable only to discharging in full all valid claims by the third party against the person in respect of which those moneys are payable, and no part of those moneys shall be assets of the person or applicable to the payment of the debts (other than those claims) of the person in the insolvency or in the administration of the estate of the person, and no such claim shall be provable in the insolvency or in the administration of the estate of the person.

(12) In this section, “insolvency” means—

(a) in the case of an individual, the individual is adjudicated bankrupt or there is issued, or there comes into effect, in respect of him or her—

(i) a Debt Relief Notice,

(ii) a Debt Settlement Arrangement, or

(iii) a Personal Insolvency Arrangement,

(b) in the case of a corporate body, the winding up of the body commences or—

(i) an examiner is appointed to it under Part 10 of the Companies Act 2014, or

(ii) a receiver is appointed to property of the company,

or

(c) in the case of a partnership, the dissolution of the partnership commences.

(13) Where, in respect of any one act of negligence or any one series of acts of negligence collectively constituting one event, there are two or more claimants and the total of the sums claimed for damages for injury to property or for which judgment has been recovered for damages for such injury exceeds the sum which the insurer or guarantor has insured or guaranteed, the liability, as regards each claimant, of the insurer or guarantor in relation to such damages shall be reduced to the appropriate proportionate part of the sum insured or guaranteed.

(14) In this section, “the person” includes an individual, a partnership, or any corporate body.

(15) In this section, a “third party” means a consumer who is or may be entitled to benefit under the terms of a contract of insurance, whether by way of indemnity or as a person who incurs an injury or loss to which the contract of insurance applies.

(16) It is irrelevant for the purposes of this section whether or not the liability of the insured person is or was incurred voluntarily.

Section 22

Section 22

Supplemental provisions in relation to section 21

22. (1) This section applies where a person claims that the person is a person (the “third party”) in whom the rights (against the insurer) of the other person referred to in subsection (1) of section 21 (the “insured”) have been vested under that subsection.

(2) Where this section applies and the third party has not yet established the insured’s liability which is insured under the contract of insurance concerned, the third party may bring proceedings in the appropriate court against the insurer for either or both of the following—

(a) a declaration as to the insured’s liability to the third party,

(b) a declaration as to the insurer’s potential liability to the third party.

(3) In such proceedings the third party is entitled, subject to any defence on which the insurer may rely, to a declaration under subsection (2)(a) or (b) on proof of the insured’s liability to the third party or (as the case may be) the insurer’s potential liability to the third party.

(4) Where proceedings are brought under subsection (2)(a) the insurer may rely on any defence on which the insured could rely if those proceedings were proceedings brought against the insured in respect of the insured’s liability to the third party.

(5) Where the court makes a declaration under this section, the effect of which is that the insurer is liable to the third party, the court may give the appropriate judgment against the insurer.

(6) When bringing proceedings under subsection (2)(a), the third party may also make the insured a defendant to those proceedings.

(7) If (but only if) the insured is a defendant to proceedings under this section (whether by virtue of subsection (6) or otherwise), a declaration under subsection (2) binds the insured as well as the insurer.

(8) In this section—

(a) “appropriate court”, without prejudice to subsection (9)(c), means—

(i) in a case in which the Circuit Court would have jurisdiction in the proceedings concerned were—

(I) the proceedings to be treated as an action founded on tort, and

(II) the monetary amount for which the liability, as referred to in subsection (2)(a) or (b), is sought to be established in the proceedings to be treated as an amount of damages sought to be recovered in such an action,

the Circuit Court,

(ii) in a case in which the District Court would have jurisdiction in the matter if each of the matters referred to in clause (I) and clause (II) of subparagraph (i) were to be treated as described in that clause (I) and clause (II), respectively, the District Court,

(iii) in any case, the High Court,

and subsection (9) supplements this paragraph,

(b) references to the insurer’s potential liability to the third party are references to the insurer’s liability in respect of the insured’s liability to the third party, if established.

(9) (a) References in subsection (8)(a), so far as it applies to the Circuit Court, to an action founded on tort shall be construed as references to an action founded on tort that is not a personal injuries action within the meaning of the Civil Liability and Courts Act 2004 but that exclusion—

(i) is for the purpose of the application to subsection (8)(a) of any enactment that specifies different jurisdictional limits, in respect of the Circuit Court, in actions founded on tort depending on whether the actions are or are not personal injuries actions (within the foregoing meaning), and

(ii) does not limit the types of wrong (within the meaning of the Civil Liability Act 1961), liability in respect of which may be the subject of a declaration by the Circuit Court under subsection (2).

(b) Subsection (8)(a)(ii) operates to confer power on the District Court to make a declaration referred to in subsection (2)(a) or (b) notwithstanding that there is not vested in the District Court, by the Courts of Justice Acts 1924 to 2014 or any other enactment, any general power to grant declaratory relief.

(c) Any enactment that provides means whereby the parties to a cause or proceedings may consent to the Circuit Court or the District Court, as the case may be, having jurisdiction, without restriction as to the monetary amount of the claim, in the cause or proceedings shall apply for the purposes of subsections (2) and (8) as it applies otherwise and where those means are duly used by the parties subsection (8)(a)(i) or (ii), as the case may be, shall be construed and have effect accordingly.

Section 23

Section 23

Subrogation: modification in family and personal relationships and in employment

23. (1) (a) This subsection applies where an insurer is liable under a contract of insurance in respect of a loss and but for this subsection the insurer would be entitled to be subrogated to the rights of the consumer against some other person (in this subsection referred to as “the other person”) and the consumer has not exercised those rights and might reasonably be expected not to exercise those rights by reason of—

(i) the consumer and the other person being members of the same family or being cohabitants, or

(ii) the consumer having expressly or impliedly consented to the use, by the other person, of a motor vehicle that is the subject matter of the contract.

(b) This subsection does not apply where the conduct of the other person that gave rise to the loss was serious or wilful misconduct.

(c) Where the other person is not insured in respect of that other person’s liability to the consumer, the insurer does not have the right to be subrogated to the rights of the consumer against the other person in respect of the loss.

(d) Where the other person is so insured, the insurer may not, in the exercise of the insurer’s rights of subrogation, recover from the other person an amount that exceeds the amount that the other person may recover under the other person’s contract of insurance in respect of the loss.

(e) (i) A consumer need not comply with a condition requiring the consumer to assign those rights to the insurer in order to be entitled to payment in respect of the loss and an insurer shall not purport to impose such a condition on the making of such a payment or, before making such a payment, invite the consumer so to assign those rights, or suggest that the consumer so assign them.

(ii) An assignment made in compliance with such a condition or in pursuance of such an invitation or suggestion is void.

(2) An insurer shall not be entitled to exercise rights of subrogation against an employee of the insured employer except when it proves that the loss was caused by such a person intentionally or recklessly and with knowledge that the loss would probably result.

(3) In this section—

(a) the reference to persons being members of the same family shall be construed in accordance with the Employment Equality Act 1998;

(b) “cohabitant” has the meaning given to it by the Civil Partnership and Certain Rights and Obligations of Cohabitants Act 2010.

Section 24

Section 24

Subrogation: distribution of recovered funds

24. (1) This section applies where—

(a) an insurer is liable under a contract of insurance in respect of a loss,

(b) the insurer has a right of subrogation in respect of the loss, and

(c) an amount is recovered (whether by the insurer or the consumer) from another person in respect of the loss.

(2) (a) If the amount is recovered by the insurer in exercising the insurer’s right of subrogation in respect of the loss, the insurer is entitled under this paragraph to so much of the amount as does not exceed the sum of—

(i) the amount paid by the insurer to the consumer in respect of the loss, and

(ii) the amount paid by the insurer for administrative and legal costs incurred in connection with the recovery.

(b) If the amount recovered exceeds the amount to which the insurer is entitled under paragraph (a), the consumer is entitled under this paragraph to so much of the excess as does not exceed the consumer’s overall loss.

(c) If the amount recovered exceeds the sum of—

(i) the amount to which the insurer is entitled under paragraph (a), and

(ii) the amount (if any) to which the consumer is entitled under paragraph (b),

the insurer is entitled to the excess.

(3) (a) If the amount is recovered by the consumer, the consumer is entitled under this paragraph to so much of the amount as does not exceed the sum of—

(i) the consumer’s overall loss, and

(ii) the amount paid by the consumer for administrative and legal costs incurred in connection with the recovery.

(b) If the amount recovered exceeds the amount to which the consumer is entitled under paragraph (a), the insurer is entitled to so much of the excess as does not exceed the amount paid by the insurer to the consumer in respect of the loss.

(c) If the amount recovered exceeds the sum of—

(i) the amount to which the consumer is entitled under paragraph (a), and

(ii) the amount (if any) to which the insurer is entitled under paragraph (b),

the consumer is entitled to the excess.

Section 25

Section 25

Contracts affecting subrogation and third parties

25. (1) Where a contract of insurance includes a provision that has the effect of excluding or limiting the insurer’s liability in respect of a loss because the consumer is a party to an agreement that excludes or limits a right of the consumer to recover damages from a person other than the insurer in respect of the loss, the insurer may not rely on the provision unless the insurer informed the consumer on paper or on another durable medium and in terms that are clear and unambiguous, before the contract of insurance was entered into, of the effect of the provision.

(2) For the purposes of any matter related to subrogation under this Act, a reference to a consumer includes a reference to a third party.

Section 26

Section 26

Effect of failure to comply with Act

26. (1) Without prejudice to the remedies provided for in section 9 and section 18, and subject to subsection (2), a court of competent jurisdiction may in its discretion—

(a) where a consumer is in breach of any duties under this Act (other than those to which section 9 and section 18 apply) order that the sum otherwise recoverable in a claim under a contract of insurance shall be reduced in proportion to the breach involved, or

(b) where an insurer is in breach of any duties under this Act (other than those to which section 9 and section 18 apply) order that the sum otherwise payable in a claim under a contract of insurance shall be increased in proportion to the breach involved.

(2) Where there has been a breach by the consumer or, as the case may be, by the insured of any duty under this Act, the court may decline to make any order under subsection (1) where—

(a) the breach of the duty was not deliberate, and

(b) it would be just and equitable in the circumstances to dispense with compliance with the duty for the purposes of subsection (1).

(3) A term or condition of a contract of insurance is void if it purports to impose on the consumer the burden of proving that the insurer has complied or not complied with an obligation imposed on the insurer in accordance with this Act (including those to which section 9 and section 18 apply).

(4) The power under subsection (1)(b) shall not be exercised to an extent that such exercise would have the result that the total sum payable in respect of the claim concerned exceeds the monetary amount which, in the proceedings, the court would have jurisdiction to award.

Section 27

Section 27

Short title and commencement

27. (1) This Act may be cited as the Consumer Insurance Contracts Act 2019.

(2) This Act shall come into operation on such day or days as the Minister for Finance may by order or orders appoint either generally or with reference to any particular purpose or provision and different days may be so appointed for different purposes or different provisions.

Annotations

Editorial Notes:

E1

Power pursuant to subs. (2) exercised (31.08.2020) by Consumer Insurance Contracts Act 2019 (Commencement) Order 2020 (S.I. No. 329 of 2020).

3. The 1st day of September 2020 is appointed as the day on which the Act, other than –

(a) subsection (4) of section 18, and

(b) the provisions of the Act specified in Article 4,

shall come into operation.

4. The 1st day of September 2021 is appointed as the day on which sections 8, 9 and 12 and subsections (1) to (5) of section 14 of the Act shall come into operation.

Number 53 of 2019

Consumer Insurance Contracts Act 2019

REVISED

Updated to 1 January 2023

About this Revised Act

This Revised Act presents the text of the Act as it has been amended since enactment, and preserves the format in which it was passed.

Related legislation

This Act is not collectively cited with any other Act.

Annotations

This Revised Act is annotated and includes textual and non-textual amendments, statutory instruments made pursuant to the Act and previous affecting provisions.

An explanation of how to read annotations is available at

www.lawreform.ie/annotations.

Material not updated in this revision

Where other legislation is amended by this Act, those amendments may have been superseded by other amendments in other legislation, or the amended legislation may have been repealed or revoked. This information is not represented in this revision but will be reflected in a revision of the amended legislation if one is available.

Where legislation or a fragment of legislation is referred to in annotations, changes to this legislation or fragment may not be reflected in this revision but will be reflected in a revision of the legislation referred to if one is available.

A list of legislative changes to any Act, and to statutory instruments from 1972, may be found linked from the page of the Act or statutory instrument at

www.irishstatutebook.ie.

Acts which affect or previously affected this revision

• Insurance (Miscellaneous Provisions) Act 2022 (11/2022)

All Acts up to and including Local Government (Maternity Protection and Other Measures for Members of Local Authorities) Act 2022 (52/2022), enacted 21 December 2022, were considered in the preparation of this revision.

Statutory instruments which affect or previously affected this revision

• Consumer Insurance Contracts Act 2019 (Commencement) Order 2020 (S.I. No. 329 of 329)

All statutory instruments up to and including Planning And Development And Foreshore (Amendment) Act 2022 (Commencement) Order 2023 (S.I. No. 1 of 2023), made 9 January 2022, were considered in the preparation of this revision.