Health Insurance Act 1994 (Information Returns) Regulations 2009

S.I. No. 294 of 2009

HEALTH INSURANCE ACT 1994 (INFORMATION RETURNS) REGULATIONS 2009

REVISED

Updated to 1 July 2024

This Revised Statutory Instrument is an administrative consolidation of Health Insurance Act 1994 (Information Returns) Regulations 2009. It is prepared by the Law Reform Commission in accordance with its function under Law Reform Commission Act 1975 (3/1975) to keep the law under review and to undertake revision and consolidation of statute law.

All Acts up to and including Health (Assisted Human Reproduction) Act 2024 (18/2024), enacted 2 July 2024, and all statutory instruments up to and including International Protection Act 2015 (Safe Countries of Origin) (Amendment) (No. 2) Order 2024 (S.I. No. 327 of 2024), made 1 July 2024, were considered in the preparation of this Revised Statutory Instrument.

Disclaimer: While every care has been taken in the preparation of this Revised Act, the Law Reform Commission can assume no responsibility for and give no guarantees, undertakings or warranties concerning the accuracy, completeness or up to date nature of the information provided and does not accept any liability whatsoever arising from any errors or omissions. Please notify any errors, omissions and comments by email to

revisedacts@lawreform.ie.

HEALTH INSURANCE ACT 1994 (INFORMATION RETURNS) REGULATIONS 2009

REVISED

Updated to 1 July 2024

Notice of the making of this Statutory Instrument was published in “Iris Oifigiúil” of 31st July, 2009.

I, MARY HARNEY, Minister for Health and Children, in exercise of the powers conferred on me by sections 3(1) (as amended by section 13(b) of the Health Insurance (Amendment) Act 2001 (No. 17 of 2001) and section 5 of the Health Insurance (Miscellaneous Provisions) Act 2009 (No. 24 of 2009)) and 7D(1) (as inserted by section 9 of the Health Insurance (Miscellaneous Provisions) Act 2009 (No. 24 of 2009)) of the Health Insurance Act 1994 (No. 16 of 1994), hereby make the following Regulations:

PART 1

GENERAL

Section

Section

1. These Regulations may be cited as the Health Insurance Act 1994 (Information Returns) Regulations 2009.

Section

Section

2. (1) In these Regulations—

F1[“Act of 1994" means the Health Insurance Act 1994 (No. 16 of 1994);]

“appropriate health services” means health services in relation to the diagnosis or treatment of the illness or injury of a patient which would be accepted generally by the medical profession as appropriate and necessary, having regard to good standards of medical practice and to the nature and cost of any alternative forms of treatment as well as to all of the circumstances relevant to the patient;

“cell” or “specified cell” means a group of insured persons who belong to both a common gender and a common prescribed age band;

“cell prescribed benefits” means the sum of all prescribed benefits paid, in respect of settled claims which acquired that status during the quarter concerned, to or on behalf of covered persons but disregarding any prescribed benefits paid which have been taken into account under a previous settled claim;

“cell claim value” means the sum of all in-patient and day-patient days, in respect of settled claims which acquired that status during the quarter concerned, in respect of covered persons but disregarding any such hospital stays which have been taken into account under a previous settled claim;

F2["cell claim value (overnight stays)" means the sum of all in-patient days, in respect of settled claims which acquired that status during the quarter concerned, in respect of covered persons but disregarding any such hospital stays which have been taken into account under a previous settled claim;]

F3["cell returned benefits" means the sum of all returned benefits paid, in respect of settled claims which acquired that status during the quarter concerned, to or on behalf of covered persons but disregarding any returned benefits paid which have been taken into account under a previous settled claim;]

F2["cell returned benefits (hospital consultants)" means the sum of all returned benefits (hospital consultants) paid, in respect of settled claims which acquired that status during the quarter concerned, to or on behalf of covered persons but disregarding any returned benefits (hospital consultants) paid which have been taken into account under a previous settled claim;

"cell returned benefits (private hospitals)" means the sum of all returned benefits (private hospitals) paid, in respect of settled claims which acquired that status during the quarter concerned, to or on behalf of covered persons but disregarding any returned benefits (private hospitals) paid which have been taken into account under a previous settled claim;

"cell returned benefits (publicly-funded hospitals)" means the sum of all returned benefits (publicly-funded hospitals) paid, in respect of settled claims which acquired that status during the quarter concerned, to or on behalf of covered persons but disregarding any returned benefits (publicly-funded hospitals) paid which have been taken into account under a previous settled claim;]

“claim” means an application by, or on behalf of, an insured person to a registered undertaking for the discharge or reimbursement, under the terms of a health insurance contract, of all or part of the fees or charges due to a health services provider in respect of the provision of prescribed health services during a hospital stay or stays;

“covered persons”, in relation to a registered undertaking, means—

(a) insured persons who on the last day of a specified period were named in a health insurance contract effected by that registered undertaking and who belonged on that day to a specified cell or combinations of cells,

(b) persons not already included under subparagraph (a) who, during the same specified period as in that subparagraph, were named in a health insurance contract effected by the registered undertaking and who, but for the cessation of their health insurance contract, would have belonged to a specified cell or combination of cells on the last day of that specified period, or

(c) persons not already included under subparagraph (a) or (b) and—

(i) in respect of whom there was a settled claim during the same specified period as in subparagraph (a), and

(ii) who were formally named in a health insurance contract effected by the registered undertaking and who, but for the cessation of their health insurance contract, would have belonged to a specified cell or combination of cells on the last day of that specified period;

“corrective payment” means a payment made to, or an amount recovered from, a health service provider or an insured person in respect of prescribed health services for which an incorrect payment, other than one arising from a systematic error in the method of processing claims, was made;

F1[“day-patient day“ means—

(a) a day, including a day upon which an in-patient stay commences and ceases, during the course of which an insured person is maintained in private hospital accommodation for the purpose of receiving day-patient services, or

(b) a day, including a day upon which an in-patient stay commences and ceases, during the course of which an insured person is maintained F4[…] in a publicly-funded hospital where a charge is payable under section 55 of the Health Act 1970 (No.1 of 1970) for such a stay for the purpose of receiving day-patient services;]

“data adjustment” has the meaning assigned to it by Regulation 5(9);

“dependent person” has the meaning assigned to it by section 1 of the Health (Nursing Homes) Act 1990 (No. 23 of 1990);

“fixed price procedure” means any prescribed health service, the benefit for which is payable by an undertaking to a publicly funded hospital or a private hospital, on behalf of an insured person by reference to a specified monetary amount agreed between the undertaking and the hospital as representing full settlement of all charges and fees arising;

F5["Fund" and "high cost claim credit" have the meanings assigned to them by section 6A(1) of the Act of 2004;]

“gross provider payment”, in relation to a settled claim, means a payment or payments, based on proper and correct accounts, due, or nominally due, from a registered undertaking to a health services provider or in respect of services rendered by that provider, disregarding the effect of—

(a) any third party recoveries in respect of that claim,

(b) any corrective payments in respect of that claim,

(c) any discounts, overall limits or like reductions or bonuses or other additional compensation which may have been agreed between that provider and that undertaking, and

(d) any reinsurance recoveries in respect of that claim;

“health services provider” means a publicly-funded hospital, private hospital, registered nursing home or hospital, private psychiatric hospital or hospital consultant, as appropriate;

“hospital consultant” means a registered medical or dental practitioner who by reason of his or her training, skill and experience in a designated speciality, is consulted by other registered medical practitioners and who has a continuing clinical and professional responsibility for patients under his or her care, or that aspect of care on which he or she has been consulted;

“hospital stay” means an in-patient stay or a day-patient day or any attendance at a hospital during the provision of services described in item 1 of the table to Article 1 of Schedule 1 while the insured person was maintained in accommodation other than private hospital accommodation;

“in-patient day” means a day during an in-patient stay where the day on which the stay ceased is deemed a whole day and the day on which that stay commenced is disregarded, except that if that stay commenced and ceased on the same day then that day shall be deemed a day-patient day;

F6[…]

F2["in-patient stay" means—

(a) an in-patient stay (private hospital), or

(b) an in-patient stay (publicly-funded hospital);

"in-patient stay (private hospital)" means a continuous period during which an insured person is maintained in private hospital accommodation in a private hospital for the purpose of receiving hospital in-patient services, such period-

(a) to commence on the occurrence of the later of—

(i) the most recent admission or transfer of that person to private hospital accommodation in a private hospital, or

(ii) the cessation of the most recent previous hospital in-patient stay in a private hospital in respect of that person,

and

(b) to cease on the occurrence of the earlier of—

(i) the next subsequent discharge or transfer of that person from private hospital accommodation in a private hospital,

(ii) the death of that person, or

(iii) the date designated as the cessation date of that period by the registered undertaking which effected the health insurance contract under which that person is named;

"in-patient stay (publicly-funded hospital)" means a continuous period during which an insured person stays overnight F4[…] in a publicly-funded hospital where a charge is payable under section 55 of the Health Act 1970 for such a stay for the purpose of receiving hospital in-patient services, such period—

(a) to commence on the occurrence of the later of—

(i) the most recent admission or transfer of that person to the hospital bed, or

(ii) the cessation of the most recent previous hospital in-patient stay in respect of that person,

and

(b) to cease on the occurrence of the earlier of—

(i) the next subsequent discharge or transfer of that person from the hospital bed,

(ii) the death of that person, or

(iii) the date designated as the cessation date of that period by the registered undertaking which effected the health insurance contract under which that person is named;]

“initial waiting period” shall be construed in accordance with the Health Insurance Act 2001 (Open Enrolment) Regulations 2005 (S.I. No. 332 of 2005);

“insured person” means—

(a) a person named in a health insurance contract as an insured person, and

(b) from date of birth, any infant born to any person named in a health insurance contract, provided that the person who effected the said contract requests that it be altered to name any such infant as an insured person, and pays the appropriate premium, if any, in that respect, within 13 weeks of the infant’s date of birth,

but does not include—

(i) any person named in a health insurance contract which does not relate to inpatient indemnity services,

(ii) any person named in a health insurance contract which relates solely to public hospital daily in-patient charges under Regulations made pursuant to section 53 of the Health Act 1970 (No. 1 of 1970), or

(iii) any person who has not completed an initial waiting period;

“medical condition” means any disease, illness or injury;

F5["member number" means an identifiable unique number corresponding to an insured person and all consecutive or continuous contracts held by the said insured person;]

“net provider payment” has the meaning assigned to it by Regulation 4(2);

F5["notifiable claim" means an amount or amounts discharged or reimbursed on application by, or on behalf of, an insured person to a registered undertaking, under the terms of a health insurance contract where such amount exceeds €10,000 for that contract;]

“nursing home” or “registered nursing home” has the meaning assigned to it by section 2 of the Health (Nursing Homes) Act 1990 (No. 23 of 1990);

F7[“prescribed age band" means one of the following 91 age ranges:

(a) under one year of age at the start of a specified period;

(b) one year of age but under 2 years of age at the start of a specified period;

(c) for each year of age starting from 2 years of age up to and including 89 years of age such that—

(i) the first age range is 2 years of age but under 3 years of age at the start of a specified period, and

(ii) the last age range is 89 years of age but under 90 years of age at the start of a specified period;

(d) 90 years of age and over at the start of a specified period;]

“prescribed benefits” shall be construed in accordance with Regulation 4;

“prescribed health services” means—

(a) hospital in-patient services, including any day-patient service,

(b) health services provided by a hospital consultant in conjunction with a hospital stay, or

(c) in relation to health services received outside the State, services equivalent to those at subparagraph (a) or (b) provided in accordance with the terms of a health insurance contract,

where such services are provided—

(i) as a result of the patient having been referred to the health services provider by a registered medical practitioner,

(ii) in an emergency, or

(iii) in connection with an obstetric condition,

and are appropriate health services, the sole purpose of which is the medical investigation, treatment, cure or alleviation of the symptoms, of illness or injury but excluding—

(I) treatment directly or indirectly arising from, or required in connection with, male and female birth control, infertility or any form of assisted reproduction,

(II) dental, orosurgical or orthodontic treatment or consultation with a dental practitioner,

(III) cosmetic services or treatment except the correction of accidental disfigurement or significant congenital disfigurement,

(IV) health services relating to eating disorders or weight reduction,

(V) preventive health services such as check-ups or screenings,

(VI) health services provided by a nursing home other than a registered nursing home,

(VII) nursing care, whether provided in an institution or otherwise, to persons who are dependent persons, and

(VIII) health services necessitated directly or indirectly by war or civil disturbance;

“private hospital” means a hospital (including an approved centre within the meaning of section 63 of the Mental Health Act 2001 (No. 25 of 2001)) which—

(a) provides prescribed health services, and

(b) is not a publicly-funded hospital,

but excluding a nursing home, or a hospital which is outside the State;

F7[“private hospital accommodation" means—

(a) accommodation in a private hospital, whether or not in a bed, or

(b) accommodation in a publicly-funded hospital F8[where a charge is payable under section 55 of the Health Act 1970;]]

“private psychiatric hospital” means a centre, within the meaning of section 62 of the Mental Health Act 2001 (No. 25 of 2001), registered pursuant to section 64 of that Act;

“publicly-funded hospital” means a hospital, other than a private hospital or nursing home, which provides services to a person pursuant to his or her entitlement under Chapter II of Part IV of the Health Act 1970 (No. 1 of 1970);

“quarter” has the meaning assigned to it by section 2(1) of the Act of 1994;

“relevant period” has the meaning assigned to it by section 7D(1)(b) of the Act of 1994;

F3["returned benefits", in respect of each settled claim, means the sum of the net provider payments under that claim;]

F2["returned benefits (hospital consultants)" in respect of each settled claim, means the sum of the net provider payments under that claim paid to hospital consultants;

"returned benefits (private hospitals)" in respect of each settled claim, means the sum of the net provider payments under that claim paid to private hospitals;

"returned benefits (publicly-funded hospitals)" in respect of each settled claim, means the sum of the net provider payments under that claim paid to publicly funded hospitals;]

“returning undertakings” means all registered undertakings or former registered undertakings required to make the information return concerned by virtue of section 7D(4) of the Act of 1994;

“screening” means a medical examination or test that is not reasonably required for the diagnosis of, or management of, the medical condition of an insured person;

“settled claim” means a claim in respect of which payments due have been made but excluding any claim in respect of a person who, at the time of the hospital stay or stays to which the claim relates, had not completed an initial waiting period;

“third party recovery” means a payment made to a registered undertaking as a result of payments made by a third party for fees or charges arising from the provision of prescribed health services to an insured person other than payments made in respect of a contract of F7[reinsurance;]

(2) The definitions of “quarter” and “relevant period” in paragraph (1) shall not be construed to prejudice the generality of the application of section 19 of the Interpretation Act 2005 (No. 23 of 2005) to the construction of these Regulations.

Annotations

Amendments:

F1

Substituted (19.12.2013) by Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2013 (S.I. No. 522 of 2013), reg. 3(a), (d).

F2

Inserted (19.12.2013) by Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2013 (S.I. No. 522 of 2013), reg. 3(b), (c), (f), (g).

F3

Inserted (21.12.2011) by Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2011 (S.I. No. 690 of 2011), reg. 3(a), (d).

F4

Deleted (1.03.2016) by Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2015 (S.I. No. 608 of 2015), reg. 3(a), (b), in effect as per reg. 1(2).

F5

Inserted (30.03.2022) by Health Insurance Act 1994 (Information Returns) (Amendment)Regulations 2022 (S.I. No. 148 of 2022), reg. 3(a), (b), (c).

F6

Deleted (19.12.2013) by Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2013 (S.I. No. 522 of 2013), reg. 3(e).

F7

Substituted (21.12.2011) by Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2011 (S.I. No. 690 of 2011), reg. 3(b), (c), (e).

F8

Substituted (1.03.2016) by Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2015 (S.I. No. 608 of 2015), reg. 3(c), in effect as per reg. 1(2).

Section

Section

3. The Authority shall have all powers that are necessary for or incidental to the performance of its functions in relation to these Regulations.

PART 2

DETERMINATION OF PRESCRIBED BENEFITS

Section

Section

4. (1) A returning undertaking shall calculate and record, in respect of each settled claim, the amount of prescribed benefits F9[and the amount of returned benefits] in accordance with the provisions of this Regulation and Schedules 1 and 2.

(2) In respect of each settled claim and for each health services provider, the returning undertaking shall determine an amount (to be known for the purposes of these Regulations as the “net provider payment”), being the gross provider payment in respect of that claim and that provider multiplied by an amount determined in accordance with the formula:

A

B

where, for the quarter in which that claim was settled—

A is the sum of:

(a) the total of actual amounts which that undertaking has paid, disregarding the effect of any corrective payments and third party recoveries, in respect of all settled claims which acquired that status during that quarter; and

(b) the net total of corrective payments relating to that undertaking during that quarter, provided that this amount shall be subject to an upper limit of 0.5% of B and be subject to a lower limit of –0.5% of B, reduced by the total of any third party recoveries made by that undertaking during that quarter; and

B is the sum of that undertaking’s gross provider payments under all settled claims which acquired that status during that quarter.

(3) The prescribed benefits in respect of each settled claim shall be the sum of the net provider payments under that claim, where each such net provider payment is subject to the maximum limits specified in Schedule 1 as regards the type of payments contained therein.

Annotations

Amendments:

F9

Inserted (21.12.2011) by Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2011 (S.I. No. 690 of 2011), reg. 4.

PART 3

SPECIFICATION AND MAKING OF INFORMATION RETURNS

Section

Section

5. F10[(1) Each returning undertaking shall make information returns to the Authority in accordance with section 7D of the Act of 1994 and the returns shall be electronically submitted such that the Authority can readily process the information contained in the returns.]

(2) F11[Notwithstanding paragraph (3)(c), Form No. 1] set out in Schedule 2 shall be the prescribed form of information return to be completed by each returning undertaking and submitted to the Authority.

F12[(3) A returning undertaking shall ensure that each of its information returns contains the following:

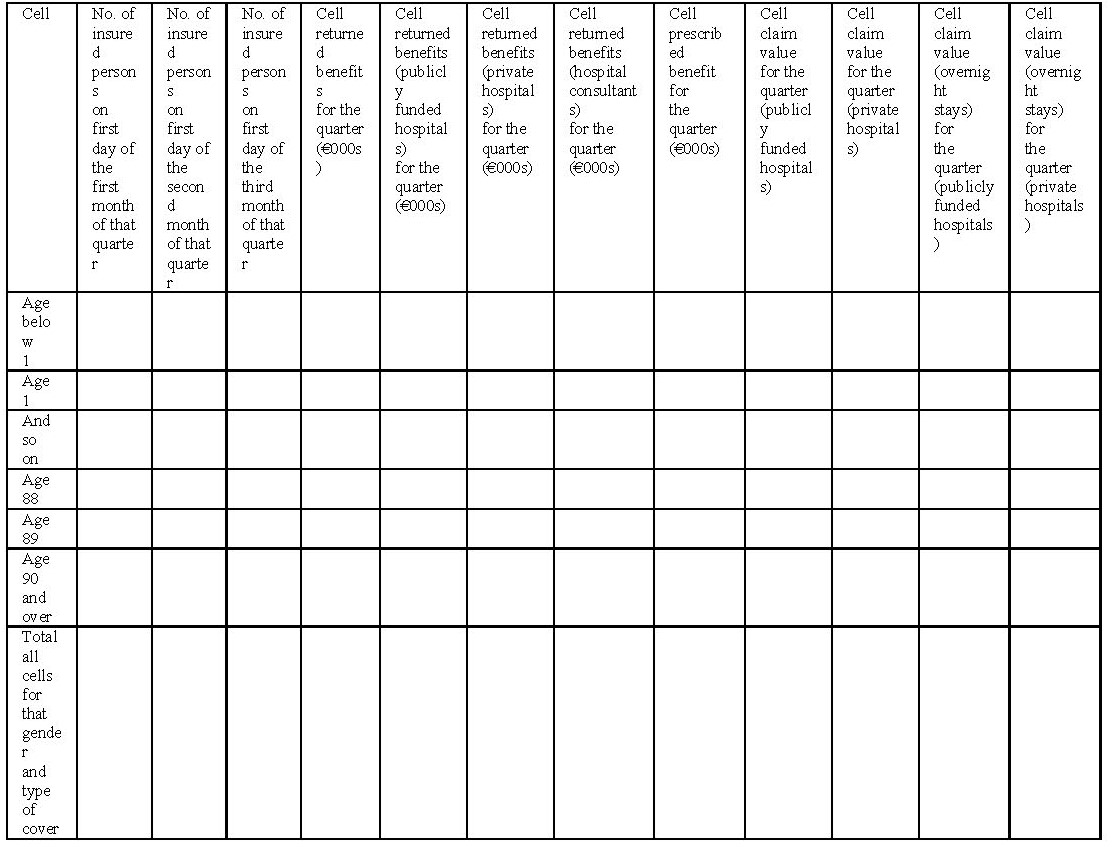

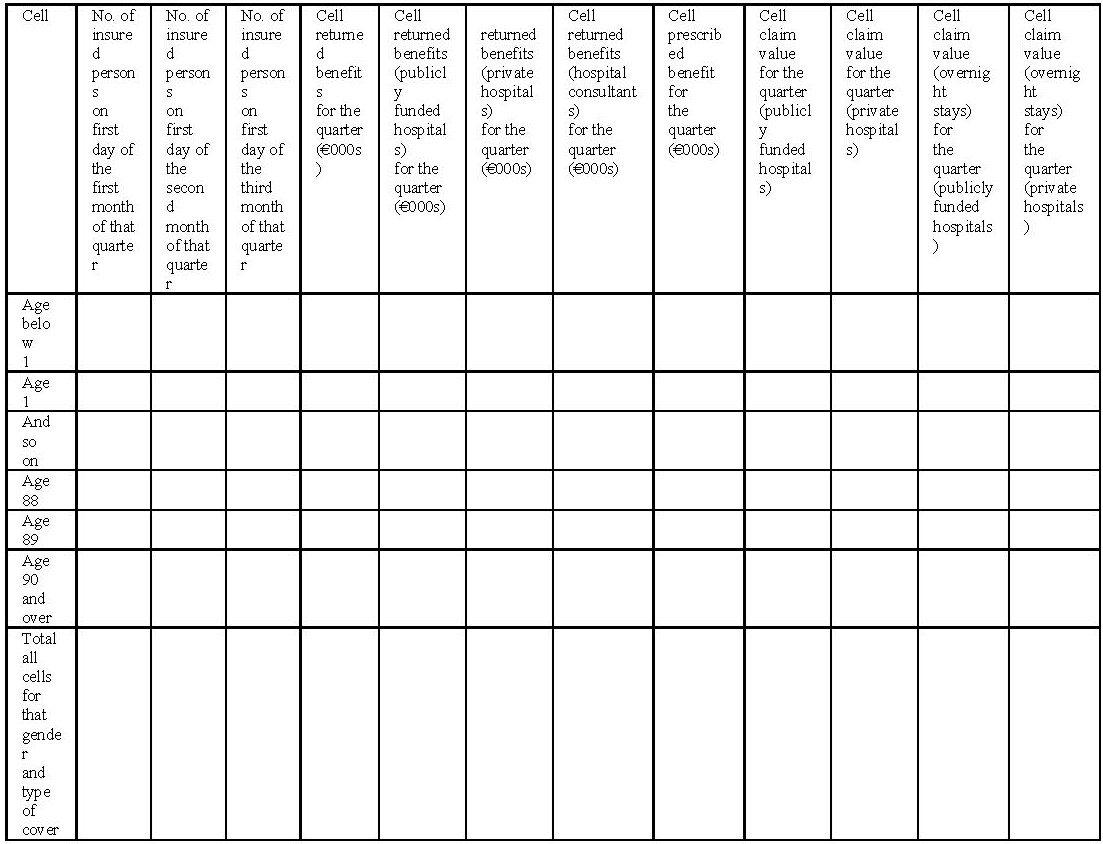

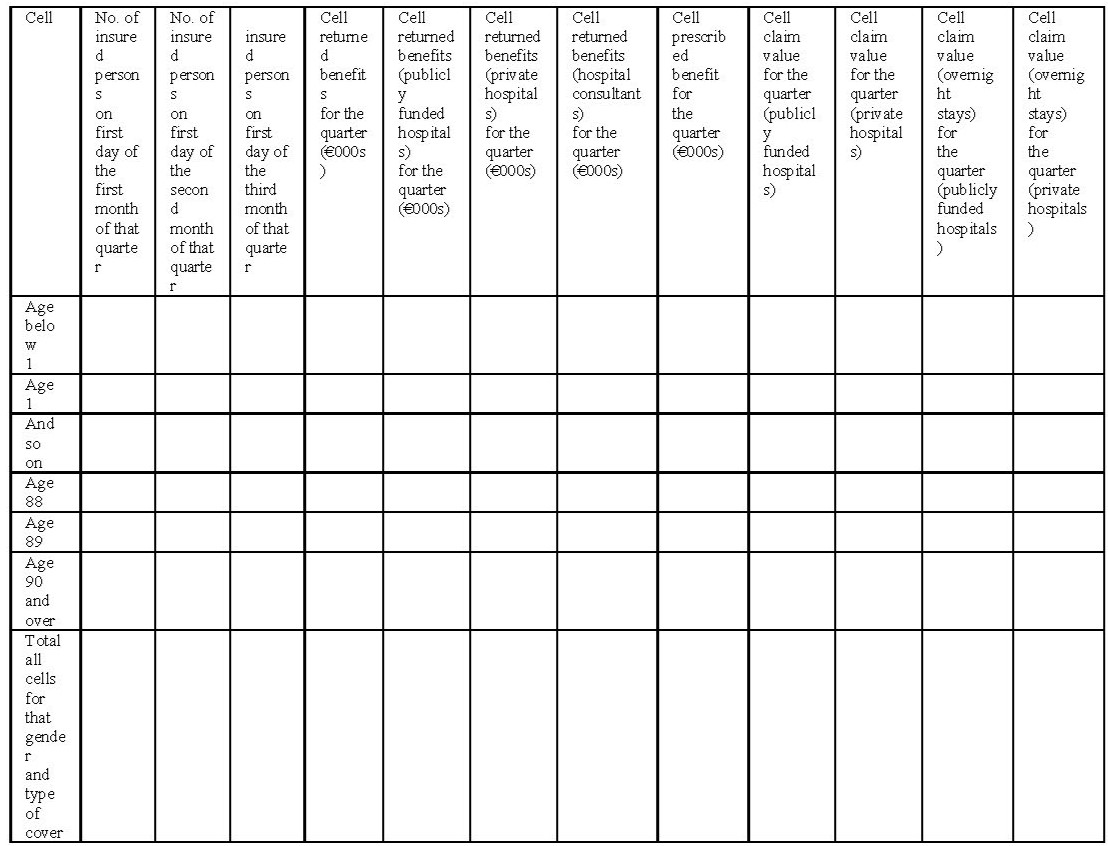

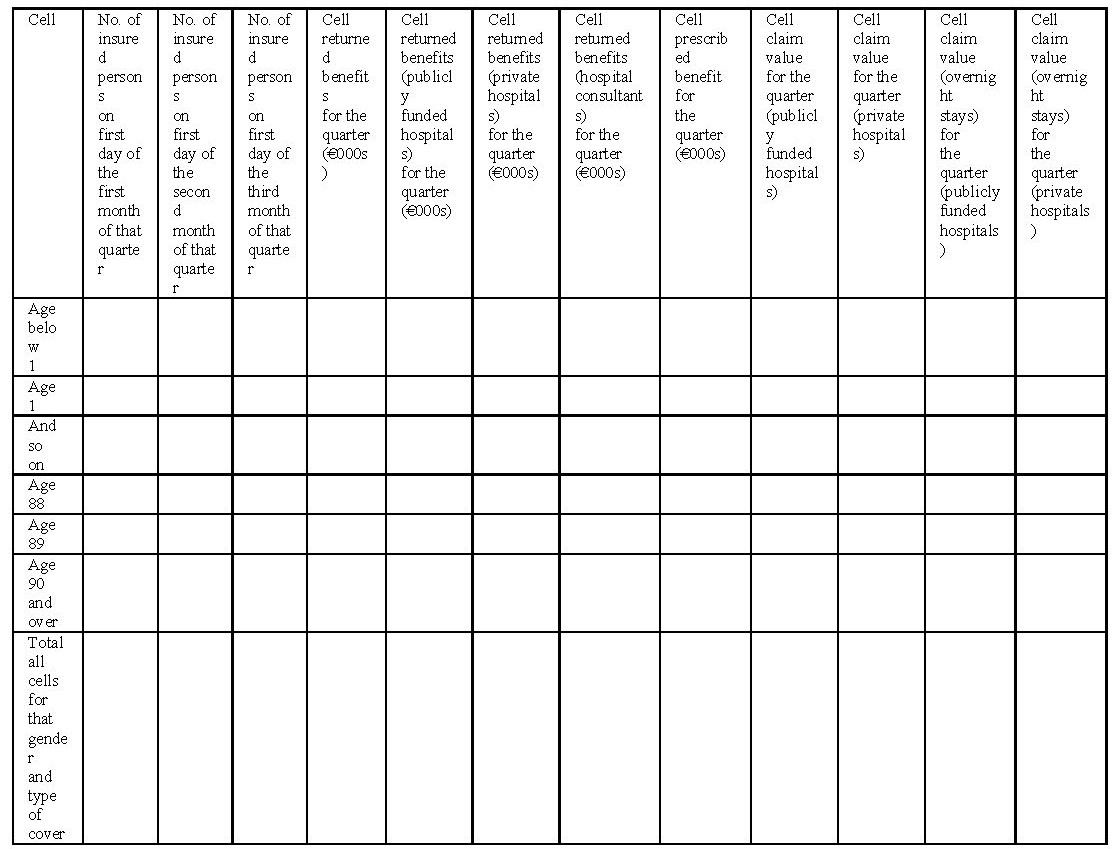

(a) for each quarter within the relevant period to which the return relates and for each type of cover, the details specified herein in respect of each cell by gender and related aggregate details:

(i) the number of insured persons on the first day of each month of the quarter;

(ii) the cell returned benefits for the quarter;

(iii) the cell returned benefits (publicly funded hospitals) for the quarter;

(iv) the cell returned benefits (private hospitals) for the quarter;

(v) the cell returned benefits (hospital consultants) for the quarter;

(vi) the cell prescribed benefits for the quarter;

F11[(vii) the cell claim value for the quarter, with a breakdown of the sum of in-patient and day-patient days between publicly funded hospitals and private hospitals;

(viii) the cell claim value (overnight stays) for the quarter, with a breakdown of the sum of all in-patient days between publicly funded hospitals and private hospitals;]

(ix) the aggregate details in respect of clauses (i) to (viii) for the gender concerned; and

(x) the aggregate details corresponding to clauses (i) to (viii) for all cells for both genders combined;

and

(b) where the quarter is the second quarter of the relevant period, in respect of each type of cover, the number of insured persons on the first day of the first month of the first quarter of the immediately succeeding relevant period in respect of each cell F11[by gender;]]

F13[(c) for all notifiable claims, the details specified herein, split by contract period and split monthly based on date of provision of services and date of payment, in the form specified by the Authority pursuant to section 11G of the Act of 2004:

(i) details of insured individual for each health insurance contract including membership number, age, gender, type of cover and whether the type of cover is specified as advanced cover by the Authority under section 11E of the Act of 1994;

(ii) details of risk equalisation credit claimed from the Fund under section 11C of the Act of 1994 excluding high cost claim credits.

(iii) breakdown of the notifiable claim amount into that relating to services rendered—

(I) in a publicly funded hospital,

(II) in a private hospital, and

(III) by a hospital consultant;

(iv) the total amount reimbursed for drugs which are not on the Reimbursement List established by the Health Service Executive under section 17 of the Health (Pricing and Supply of Medical Goods) Act 2013;

(v) the cell claim value (publicly funded hospitals);

(vi) the cell claim value (private hospitals);

(vii) the cell claim value (overnight stays) (publicly funded hospitals) and

(viii) the cell claim value (overnight stays) (private hospitals).]

(4) A returning undertaking shall ensure that each of its information returns is accompanied by an analysis, for each quarter within the relevant period to which the return relates, of the difference between—

(a) the following:

(i) the total number of persons (including such persons excluded from the definition of “insured person” by virtue of subparagraph (i), (ii) or (iii) of that definition) named in health insurance contracts effected by that registered undertaking that are in force on the first day of the quarter; and

(ii) the total number of insured persons on the first day of the quarter for all cells for both genders combined,

and

(b) the following:

(i) the total amount of payments made under health insurance contracts during the quarter; and

(ii) the total amount of the cell prescribed benefits for the quarter for all cells for both genders combined.

(5) A returning undertaking shall ensure that each of its information returns is accompanied by a statement setting out the details of the material assumptions (if any) used in preparing the return.

(6) A returning undertaking shall ensure that each of its information returns is accompanied by a report by an independent accountant stating whether or not, in the opinion of the independent accountant—

(a) the return has been prepared in accordance with these Regulations in all material respects,

(b) the material assumptions (if any) used in preparing the return are appropriate, consistently applied and adequately disclosed in the statement referred to in paragraph (5), and

(c) the return has been prepared in accordance with the underlying books and records of the undertaking.

(7) The independent accountant referred to in paragraph (6) shall set out in the report referred to in that paragraph the basis for his or her opinion referred to in that paragraph and include in the report such findings or qualifications as he or she considers ought to be included in the report in the circumstances of the case.

(8) A returning undertaking shall ensure that—

(a) each of its information returns is confirmed by being signed by 2 of its officers who are authorised to do so by the Board of that undertaking, and

(b) one of those signatories is the managing director, the chief executive officer, or the company secretary, of the undertaking, or a member of the Board of the undertaking, or a person of similar status in relation to the undertaking.

(9) If a returning undertaking detects or otherwise becomes aware of an error in an information return which it has made, it shall forthwith notify the Authority of such error and, within 7 days of becoming so aware, submit a corrected information return (to be known for the purposes of these Regulations as a “data adjustment”), together with a report setting out the reasons why the error occurred and the steps which have been taken to prevent a recurrence of any such error.

(10) If the Authority receives a data adjustment, it shall, if time permits, incorporate the data adjustment into its evaluation and analysis required under section 7E of the Act of 1994 to be carried out for the relevant period concerned. If a data adjustment is received when it is not possible to incorporate it into such evaluation and analysis or report required under section 7E of the Act of 1994 to be furnished to the Minister, and the Authority considers it to be a material data adjustment, the Authority shall advise the Minister of the impact that the data adjustment would have had on its evaluation and analysis and report as soon as is practicable after the receipt of the data adjustment. The Minister shall have regard to any such advice in making recommendations to the Minister for Finance pursuant to section 7E(2) of the Act of 1994.

Annotations

Amendments:

F10

Substituted (21.12.2011) by Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2011 (S.I. No. 690 of 2011), reg. 5(a).

F11

Substituted (30.03.2022) by Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2022 (S.I. No. 148 of 2022), reg. 4(a), (b)(i), (ii).

F12

Substituted (19.12.2013) by Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2013 (S.I. No. 522 of 2013), reg. 4.

F13

Inserted (30.03.2022) by Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2022 (S.I. No. 148 of 2022), reg. 4(b)(iii).

Editorial Notes:

E1

Previous affecting provision: para. (3) substituted (21.12.2011) by Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2011 (S.I. No. 690 of 2011), reg. 5(b); substituted (19.12.2013) as per F-note above.

PART 4

SPECIFICATION OF PENAL REGULATIONS

Section

Section

6. Paragraphs (1), (3), (4), (5), (6), (8) and (9) of Regulation 5 are hereby declared to each be a penal Regulation for the purposes of subsection (1)(b) of section 4 of the Act of 1994.

Schedule 1

Schedule 1

SCHEDULE 1

MAXIMUM LIMITS OF NET PROVIDER PAYMENTS

1. The maximum limit of net provider payments for prescribed health services provided by a publicly-funded hospital or a private hospital to an insured person, which are not fixed price procedures, are as set out in the following table:

TABLE

|

Payments in respect of:(Column 1) |

Maximum Limit:(Column 2) |

|

Item 1 Prescribed health services which are hospital in-patient services provided by a publicly-funded hospital while the insured person was maintained in accommodation other than private hospital accommodation. |

Limit for Item 1 The public hospital daily in-patient charges under Regulations made pursuant to section 53 of the Health Act 1970, and any other charges that may be payable under that Act as in force from time to time. |

|

Item 2 Prescribed health services which are hospital in-patient services provided by a publicly-funded hospital while the insured person was maintained in private hospital accommodation. |

Limit for Item 2 The amount of the charge payable under section 55 of the Health Act 1970 plus the amount of the public hospital daily in-patient charges under Regulations made pursuant to section 53 of that Act. |

|

Item 3 Prescribed health services which are hospital in-patient services provided by a private hospital other than a private psychiatric hospital. |

Limit for Item 3 The lesser of:€550 for each in-patient day;or100% of the charge made by the private hospital less €100 for each day during which the insured person was accommodated in a single room. |

|

Item 4 Prescribed health services which are day-patient services provided by a publicly-funded hospital while the insured person was maintained in private hospital accommodation. |

Limit for Item 4 The amount of the charge payable under section 55 of the Health Act 1970 plus the amount of the public hospital daily in-patient charges under Regulations made pursuant to section 53 of that Act. |

|

Item 5 Prescribed health services which are day-patient services provided by a private hospital other than a private psychiatric hospital. |

Limit for Item 5 The lesser of:€550 for each day-patient day;or100% of the charge made by the private hospital. |

|

Item 6 Prescribed health services which are hospital in-patient services provided by a private psychiatric hospital. |

Limit for Item 6 €220 for each in-patient day. |

2. The amount determined under this Schedule in respect of hospital charges relating to childbirth by means of a normal delivery shall not exceed €1,000.

3. In respect of fixed price procedures, the maximum limit of net provider payments shall be the lesser of, the amount paid or 90% of that specified in an agreement between the undertaking and the hospital as representing full settlement of all fees and charges payable for the particular services concerned.

4. The maximum limit of net provider payments in respect of prescribed health services provided by a hospital consultant shall be the amount paid by the undertaking for the particular services concerned.

5. In respect of prescribed health services provided outside of the State, the maximum limit of net provider payments shall be the lesser of, the maximum limit of net provider payments in accordance with the other provisions of this Schedule, or the amount paid by the undertaking for the particular services concerned in accordance with a health insurance contract.

Schedule 2

Schedule 2

F14[SCHEDULE 2

Form No. 1

Return to the Health Insurance Authority pursuant to Section 7D of the Health Insurance Act 1994

Return for the Period Ending .......................

(NOTE: Where the returned benefits payable under a type of cover to which this form relates have materially changed, then the undertaking concerned shall make separate returns of this form in respect of each material level of returned benefit. Also, the undertaking concerned shall make separate returns of this form in respect of the sum of all types of cover to which this form relates.)

PART 1 OF RETURN

Data for First Quarter of Period: Gender: Female

Type of cover: .................................

Returning undertaking:....................................

PART 1 OF RETURN (Continued)

Data for First Quarter of Period:

Gender: Male

Type of cover: .................................

Returning undertaking:....................................

PART 2 OF RETURN

Data for Second Quarter of Period:

Gender: Female

Type of cover: .................................

Returning undertaking:....................................

PART 2 OF RETURN

Data for Second Quarter of Period:

Gender: Male

Type of cover: .................................

Returning undertaking:....................................

Return for the Period Ending .................................. as confirmed by:

Name: ................................................. Name: ....................................................

*Position: ............................................ *Position: .................…............................

Signature: ........................................... Signature: ..............................................

Date: ................................................... Date: ..........…...…..................................]

Annotations

Amendments:

F14

Substituted (30.03.2022) by Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2022 (S.I. No. 148 of 2022), reg. 5.

Editorial Notes:

E2

Previous affecting provision: schedule substituted (19.12.2013) by Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2013 (S.I. No. 522 of 2013), reg. 6; substituted (30.03.2022) as per F-note above.

E3

Previous affecting provision: schedule substituted (21.12.2011) by Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2011 (S.I. No. 690 of 2011), reg. 6; substituted (19.12.2013) as per E-note above.

L.S.

GIVEN under my Official Seal,

29 July 2009.

MARY HARNEY,

Minister for Health and Children.

EXPLANATORY NOTE

(This note is not part of the Instrument and does not purport to be a legal interpretation.)

This statutory instrument sets out the format and content of the information returns specified in Section 7D of the Health Insurance Acts. The purpose of the information returns is to enable the Authority to report to the Minister as set out in Section 7E of the Acts and in particular to recommend any changes in the levy and tax credits having considered the need to support the principal objective as specified in the Acts.

S.I. No. 294 of 2009

HEALTH INSURANCE ACT 1994 (INFORMATION RETURNS) REGULATIONS 2009

REVISED

Updated to 1 July 2024

About this Revised Statutory Instrument

This Revised Statutory Instrument presents the text of the Instrument as it has been amended since it was made, and preserves the format in which it was made.

Related legislation

Health Insurance Act 1994 (Information Returns) Regulations 1994 to 2022: this statutory instrument is one of a group of instruments included in this collective citation, to be construed together as one (Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2022 (S.I. No. 148 of 2022), reg. 1(2)). The instruments in this group are:

• Health Insurance Act 1994 (Information Returns) Regulations 2009 (S.I. No. 294 of 2009)

• Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2011 (S.I. No. 690 of 2011)

• Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2013 (S.I. No. 522 of 2013)

• Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2015 (S.I. No. 608 of 2015)

• Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2022 (S.I. No. 148 of 2022)

Annotations

This Revised Statutory Instrument is annotated and includes textual and non-textual amendments and previous affecting provisions.

An explanation of how to read annotations is available at

www.lawreform.ie/annotations.

Material not updated in this revision

Where other legislation is amended by this instrument, those amendments may have been superseded by other amendments in other legislation, or the amended legislation may have been repealed or revoked. This information is not represented in this revision but will be reflected in a revision of the amended legislation if one is available.

Where legislation or a fragment of legislation is referred to in annotations, changes to this legislation or fragment may not be reflected in this revision but will be reflected in a revision of the legislation referred to if one is available.

A list of legislative changes to any Act, and to statutory instruments from 1972, may be found linked from the page of the Act or statutory instrument at

www.irishstatutebook.ie.

Acts which affect or previously affected this revision

None

All Acts up to and including Health (Assisted Human Reproduction) Act 2024 (18/2024), enacted 2 July 2024, were considered in the preparation of this revision.

Statutory instruments which affect or previously affected this revision

• Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2022 (S.I. No. 148 of 2022)

• Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2015 (S.I. No. 608 of 2015)

• Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2013 (S.I. No. 522 of 2013)

• Health Insurance Act 1994 (Information Returns) (Amendment) Regulations 2011 (S.I. No. 690 of 2011)

All statutory instruments up to and including International Protection Act 2015 (Safe Countries of Origin) (Amendment) (No. 2) Order 2024 (S.I. No. 327 of 2024), made 1 July 2024, were considered in the preparation of this revision.