Irish Collective Asset-Management Vehicles Act 2015

Number 2 of 2015

IRISH COLLECTIVE ASSET-MANAGEMENT VEHICLES ACT 2015

REVISED

Updated to 1 February 2021

This Revised Act is an administrative consolidation of the Irish Collective Asset-Management Vehicles Act 2015. It is prepared by the Law Reform Commission in accordance with its function under the Law Reform Commission Act 1975 (3/1975) to keep the law under review and to undertake revision and consolidation of statute law.

All Acts up to and including the Health (Amendment) Act 2021 (1/2021), enacted 7 March 2021, and all statutory instruments up to and including the Investment Limited Partnerships (Amendment) Act 2020 (Commencement) Order 2021 (S.I. No. 19 of 2021), made 22 January 2021, were considered in the preparation of this Revised Act.

Disclaimer: While every care has been taken in the preparation of this Revised Act, the Law Reform Commission can assume no responsibility for and give no guarantees, undertakings or warranties concerning the accuracy, completeness or up to date nature of the information provided and does not accept any liability whatsoever arising from any errors or omissions. Please notify any errors, omissions and comments by email to

revisedacts@lawreform.ie.

Number 2 of 2015

IRISH COLLECTIVE ASSET-MANAGEMENT VEHICLES ACT 2015

REVISED

Updated to 1 February 2021

CONTENTS

Preliminary and General

Preliminary

Section

1. Short title and commencement

2A. Supplemental interpretation provisions regarding ordinary and special resolutions

Creation of ICAVs and carrying on of business

5. Creation of ICAV with limited liability

6. Instrument of incorporation

7. Registered office and head office

8A. Capacity not limited by an ICAV’s instrument of incorporation

8B. Effect of instrument of incorporation

Registration and Authorisation of ICAVs etc.

Registration

10. Application for registration order

11. Contents of statement required by section 10(2)(b)(ii)

12. Making of registration order

13. Requirements referred to in section 12(1)(a)(ii)

14. Registration of certain matters following making of registration order

15. Commencement of registration order

16. Decision to refuse registration order

Authorisation and approval

18. Application for authorisation

20. Decision to refuse authorisation

21. Appointment and approval of depositary

22. Application for approval of management company

23. Approval of management company

24. Refusal to approve management company

25. Authorisation or approval not a warranty

26. Revocation of authorisation

27. Imposition of conditions by Bank

28. Prohibition on carrying on business as ICAV unless authorised etc.

Names and changes in instrument of incorporation

30. Approval for change of name

31. Alteration in instrument of incorporation

Execution of documents, seals, etc.

34. Official seal for share certificates

Sub-funds of umbrella funds

35. Segregated liability of ICAV sub-funds

36. Requirements to be complied with by, and other matters respecting, an umbrella fund

37. Further matters about umbrella funds

Shares and Debentures etc.

38. Power to issue shares and debentures

40. Evidence of share certificate

42. Transfer of registered shares

43. Refusal to register transfer of shares

44. Certification of transfer of shares

46. Power to purchase own shares

47. Treatment of purchased shares

50. Inspection of register of members

51. Consequences of failure to comply with requirements as to register owing to agent’s default

53. Trusts not to be entered on the register

55. Power of members to complain of oppressive conduct

Directors and Other Officers

Appointment, removal etc.

58. Prohibition on body corporate being director

59. Avoidance of acts done by person in dual capacity as director and secretary

60. Validity of acts of directors

61. Appointment of directors to be voted on individually

63. Prohibition of undischarged bankrupt acting as officer etc. of ICAV

64. Examination as to solvency status of director etc.

65. Register of directors and secretaries

66. Provisions supplementary to section 65

67. Entitlement to notify Bank of changes if section 65(6) contravened

68. Particulars relating to directors to be shown on all business letters

Controls of directors

69. Prohibition of tax-free payments to directors

71. Duty of director to disclose payments made in connection with transfer of shares

72. Sections 70 and 71: supplementary

73. Contracts of employment of directors

74. Section 73: anti-avoidance

75. Prohibition of loans etc. to directors and connected persons

77. Section 75: connected persons

Other matters

78. Fiduciary duties of directors of ICAVs

79. Statement of principal fiduciary duties of directors of ICAVs

80. Directors to have regard to interests of employees

81. Register of shareholdings of directors etc.

82. Disclosure for purposes of section 81

83. Declaration of interest in contracts

84. Breaches of certain duties: liability to account and indemnify

85. Power of court to grant relief to officers of ICAV

85A. Anticipated claim: similar power of relief as under section 85

86. Restrictions on directors of insolvent ICAVs

87. Disqualification of directors etc.

Meetings

90. Extraordinary general meetings

91. Convening of extraordinary general meetings by members

Written Resolutions

91A. Unanimous written resolutions

91B. Majority written resolutions

91C. Supplemental provisions in relation to section 91B

Charges and Debentures

Interpretation

Registration of charges and priority

93. Registration of charges created by ICAVs

95. Duty of ICAV to register charges existing on property acquired

97. Registration of judgment mortgages

99. Certificate of registration

100. Entries of satisfaction and release of property from charge

101. Extension of time for registration of charges and rectification of register

102. Copies of instruments creating charges to be kept

103. Netting of Financial Contracts Act 1995 not to affect registration requirements

Provisions as to debentures

104. Liability of trustees for debenture holders

106. Power to re-issue redeemed debentures

107. Specific performance of contracts to subscribe for debentures

Prohibition on registration of certain matters affecting shareholders

108. Registration against ICAV of certain matters prohibited

Accounts, Reports and Auditing

Accounting records

109. Obligation to keep adequate accounting records

110. Basic requirements for accounting records

111. Where accounting records are to be kept

112. Access to accounting records

113. Retention of accounting records

114. Accounting records: offences

115. Personal liability of officers where adequate accounting records not kept

Annual accounts

117. Accounts to include information about directors

Directors’ reports

119. Revised directors’ reports

Audit

120. Auditor reports on accounts

121. Consideration by auditor of consistency of directors’ report with ICAV’s accounts

122. Duty of auditor in relation to suspected commission of indictable offence

123. Eligibility to be auditor

124. Auditor acting where ineligible

128. Auditor’s access to records

131. Power of competent authority

133. Resolution for removal of auditor

134. Auditor who has been removed

136. Statement of circumstances

138. Requirements consequent on ceasing to hold office

Conversions of Investment Company or UCITS to ICAV

140. Conversion of investment company or UCITS to ICAV

142. Registration pursuant to application for conversion

143. Further statutory declarations

Migration

Migration-in to become ICAV

147. Continuation of migrating body

148. Supplementary provision in relation to section 147

De-registration following migration out

150. De-registration of ICAVs when continued under law of place outside the State

151. Provisions supplementary to section 150

Declaration of solvency

152. Statutory declaration as to solvency

Receivers and Winding Up

Receivers

Winding up

Strike Off and Restoration

Strike off of ICAV

155. When Bank may strike ICAV off register

156. Grounds for involuntary strike off

157. Bank’s notice to ICAV of intention to strike it off register

158. Contents of Bank’s notice to ICAV

160. Public notice of intention to strike ICAV off register

161. Conditions for voluntary strike off

162. Public notice in case of voluntary strike off

163. Striking off (involuntary and voluntary cases) and dissolution

164. Effect of removal and dissolution

165. Power of Bank to obtain information

Restoration of ICAV to register

167. Restoration on application to Bank

168. Restoration on application to High Court

169. Requirements for application to High Court under section 168

170. Terms of High Court order on application under section 168

171. High Court order for restoration on application of Bank

172. Supplementary High Court orders

Investigations, Compliance and Enforcement

175. Restraining directors and others from removing assets

176. Agency with responsibility for enforcement of offences

177. District court district within which summary proceedings may be brought

178. Application of other provisions relating to offences

179. Special provisions applying where default in delivery of documents to Bank

Miscellaneous

182. Registration and inspection of documents

187. Amendments of UCITS Regulations

188. Adaptation of certain provisions of UCITS Regulations

189. Amendments of Central Bank Act 1942

190. Exemption from liability void

192. Director of Corporate Enforcement

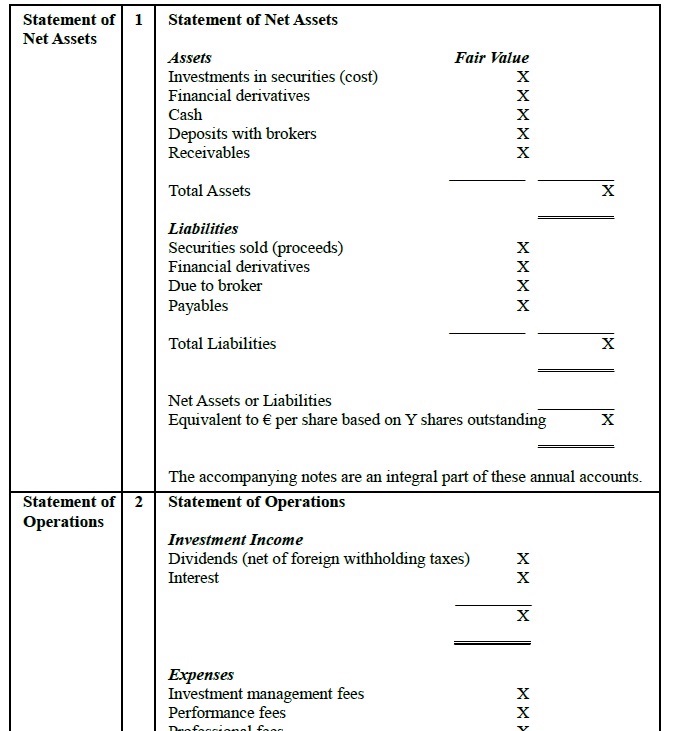

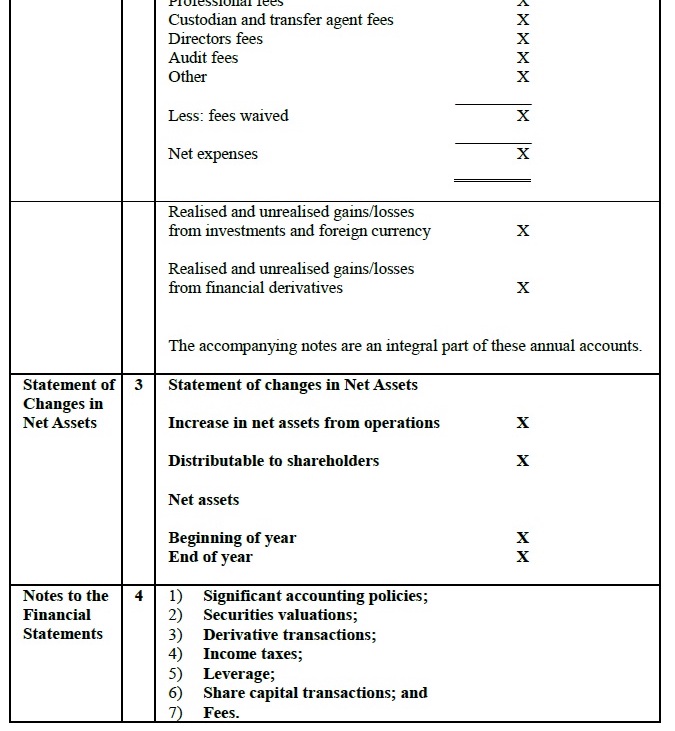

Accounts

Acts Referred to

Central Bank (Supervision and Enforcement) Act 2013 (No. 26)

Central Bank Act 1942 (No. 22)

Civil Partnership and Certain Rights and Obligations of Cohabitants Act 2010 (No. 24)

Companies Act 2014 (No. 38)

Courts of Justice Act 1924 (No. 10)

Netting of Financial Contracts Act 1995 (No. 25)

Partnership Act 1890 (3 & 4 Vict., c. 39)

Registration of Deeds and Title Act 2006 (No. 12)

Registration of Title Act 1964 (No. 16)

State Property Act 1954 (No. 25)

Taxes Consolidation Act 1997 (No. 39)

Number 2 of 2015

IRISH COLLECTIVE ASSET-MANAGEMENT VEHICLES ACT 2015

REVISED

Updated to 1 February 2021

An Act to make provision for the creation, operation and regulation of bodies corporate to be known as Irish Collective Asset-management Vehicles and to provide for related matters.

[4 th March, 2015]

Be it enacted by the Oireachtas as follows:

PART 1

Preliminary and General

Chapter 1

Preliminary

Section 1

Section 1

Short title and commencement

1. (1) This Act may be cited as the Irish Collective Asset-management Vehicles Act 2015.

(2) This Act shall come into operation on such day or days as the Minister may appoint by order or orders either generally or with reference to any particular purpose or provision and different days may be so appointed for different purposes or different provisions.

(3) In relation to times before the coming into operation of the Companies Act 2014 references in this Act to any provision of that Act have effect as references to the corresponding provisions of any enactment to be repealed by that Act.

Annotations

Editorial Notes:

E1

Power pursuant to subs. (2) exercised (12.03.2015) by Irish Collective Asset-management Vehicles Act 2015 (Commencement) Order 2015 (S.I. No. 85 of 2015).

2. The 12th day of March 2015 is appointed as the day on which the Irish Collective Asset-management Vehicles Act 2015 (No. 2 of 2015) comes into operation.

Section 2

Section 2

Definitions

2. In this Act—

“AIFM Regulations” means the European Union (Alternative Investment Fund Managers) Regulations 2013 (S.I. No. 257 of 2013);

“annual general meeting” has the meaning given by section 89(1);

F1[…]

“authorised ICAV” means an ICAV in respect of which a relevant authorisation is in operation;

“Bank” means the Central Bank of Ireland;

“Bank regulations” means regulations made by the Bank under Part 8 of the Central Bank (Supervision and Enforcement) Act 2013;

“category 1 offence” means an offence the penalties for which are specified in section 186(1);

“category 2 offence” means an offence the penalties for which are specified in section 186(2);

“category 3 offence” means an offence the penalties for which are specified in section 186(3);

F2[“category 4 offence” means an offence the penalties for which are specified in section 186(4);]

“Community act” means an act adopted by an institution of the European Union;

“company” means a company formed and registered under the Companies Act 2014 or an existing company within the meaning of that Act;

“debenture” includes debenture stock, bonds and any other securities of an ICAV whether constituting a charge on the assets of the ICAV or not;

“depositary” means a depositary within the meaning of Regulation 22(3) of the AIFM Regulations;

“disqualification order” has the same meaning as in the enactments specified in section 87 as applied in relation to an ICAV by that section;

“enactment” includes an instrument under an enactment;

“financial services legislation” has the meaning given by section 3 of the Central Bank (Supervision and Enforcement) Act 2013;

“group” means a holding company and its subsidiaries;

“holding company” has the meaning given by section 8 of the Companies Act 2014;

“ICAV” means an Irish collective asset-management vehicle;

“information” includes information contained in a document;

“instrument of incorporation” shall be read in accordance with section 6;

“investment company” has the same meaning as in Part 24 of the Companies Act 2014;

“Irish collective asset-management vehicle” means a body registered as such under this Act;

“management company”, in relation to an ICAV, means a company designated by the ICAV to undertake the management of the ICAV;

“member”, in relation to an ICAV, means a shareholder in the ICAV;

“Minister” means the Minister for Finance;

“officer”, in relation to an ICAV, includes a director or secretary;

“ordinary resolution”, in relation to an ICAV, means a resolution passed by a simple majority of the votes cast by the members of the ICAV as, being entitled to do so, vote in person or by proxy at a general meeting of the ICAV;

“register of ICAVs” means the register kept by the Bank under section 14;

“register of members”, in relation to an ICAV, means the register of members kept by it under section 49;

“Registrar” means Registrar of Companies;

“registration order” shall be read in accordance with section 12;

“relevant authorisation” means an authorisation under—

(a) section 19, or

(b) the UCITS Regulations;

“shadow director”, in relation to an ICAV, means a person in accordance with whose directions or instructions the directors of the ICAV are accustomed to act except a person in accordance with whose directions or instructions the directors are accustomed so to act by reason only that they do so on advice given by the person in a professional capacity;

“special resolution”, in relation to an ICAV, means a resolution passed by not less than 75 per cent of the votes cast by the members of the ICAV as, being entitled to do so, vote in person or by proxy at a general meeting of the ICAV;

“sub-fund” means a portfolio of assets and liabilities maintained by an ICAV in accordance with its instrument of incorporation;

“subsidiary” has the meaning given by section 7 of the Companies Act 2014;

“UCITS Regulations” means the European Communities (Undertakings for Investment in Transferable Securities) Regulations 2011 (S.I. No. 352 of 2011);

“umbrella fund” means an ICAV which has one or more sub-funds;

“undischarged bankrupt” means a person who is declared bankrupt by a court of competent jurisdiction, within the State or elsewhere, and who has not obtained a certificate of discharge or its equivalent in the relevant jurisdiction.

Annotations

Amendments:

F1

Deleted (21.09.2018) by Companies (Statutory Audits) Act 2018 (22/2018), s. 74(a), S.I. No. 366 of 2018.

F2

Inserted (1.02.2021) by Investment Limited Partnerships (Amendment) Act 2020 (31/2020), s. 42, S.I. No. 19 of 2021.

Editorial Notes:

E2

Previous affecting provision: definition of “Audits Regulations” substituted (17.06.2016) by European Union (Statutory Audits) (Directive 2006/43/EC, as amended by Directive 2014/56/EU, and Regulation (EU) No 537/2014) Regulations 2016 (S.I. No. 312 of 2016), reg. 144(2), in effect as per reg. 1(2); deleted as per F-note above.

Section

Section

F3[Supplemental interpretation provisions regarding ordinary and special resolutions

2A. (1) With respect to any question that may arise, during, or for the purposes of, any proceedings of a sub-fund or a class of members, as to whether any applicable requirement, whether arising under the instrument of incorporation of the ICAV concerned or otherwise, for—

(a) a resolution to be passed as an ‘ordinary resolution’ by that sub-fund or class, or

(b) a resolution to be passed as a ‘special resolution’ by that sub-fund or class,

has been satisfied, subsection (2) or, as appropriate, subsection (3) shall have effect.

(2) For the purposes of subsection (1)(a), a resolution passed by a simple majority of the votes cast by the members of the sub-fund or, as appropriate, of the class as, being entitled to do so, vote in person or by proxy at the general meeting concerned of the sub-fund or the meeting concerned of the class of members shall be regarded as an ordinary resolution.

(3) For the purposes of subsection (1)(b), a resolution passed by not less than 75 per cent of the votes cast by the members of the sub-fund or, as appropriate, of the class as, being entitled to do so, vote in person or by proxy at the general meeting concerned of the sub-fund or the meeting concerned of the class of members shall be regarded as a special resolution.]

Annotations

Amendments:

F3

Inserted (1.02.2021) by Investment Limited Partnerships (Amendment) Act 2020 (31/2020), s. 43, S.I. No. 19 of 2021.

Section 3

Section 3

Power to make regulations

3. (1) The Minister may make regulations—

(a) for the general purpose of this Act or for any particular purpose of this Act, and

(b) in relation to any matter referred to as the subject of regulations.

(2) Regulations under this Act may apply either generally or by reference to a specified class or classes of ICAV, or to a specified time or times, or during a specified period or periods or by reference to any other matter as the Minister may consider appropriate.

(3) Without prejudice to any specific provision of this Act, any regulations under this Act may contain such incidental, consequential, transitional or supplementary provisions as may appear to the Minister to be necessary or proper for any purpose of this Act or in consequence of, or to give full effect to, any provision of this Act.

Section 4

Section 4

Expenses

4. The expenses incurred by the Minister in the administration of this Act shall be paid out of moneys provided by the Oireachtas.

Chapter 2

Creation of ICAVs and carrying on of business

Section 5

Section 5

Creation of ICAV with limited liability

5. (1) This Act enables by means of—

(a) the furnishing of an instrument of incorporation, and certain other information, to the Bank, and

(b) compliance with the other requirements imposed by or under this Act or any other enactment,

a body corporate, of a type to be known as an Irish collective asset-management vehicle, to be formed and registered and, subject to its obtaining the relevant authorisation, to carry on business as an authorised ICAV.

F4[(2) The sole object of an ICAV shall be the collective investment of its funds in property and giving members the benefit of the results of the management of its funds, but this is subject to subsection (2A).

(2A) Where an ICAV is authorised under the UCITS Regulations, the sole object of the ICAV shall be as set out in Regulation 4(3)(a) of those Regulations.

(2B) Section 6(6) makes provision, consequent on the enactment of subsection (2A), in relation to an ICAV formed before the commencement of section 44 of the Investment Limited Partnerships (Amendment) Act 2020 and which is authorised under the UCITS Regulations.]

(3) The liability of the members of an ICAV shall be limited to the amount, if any, unpaid on the shares respectively held by them.

(4) Subsection (3) is without prejudice to any other liability to which a member may be subject as provided by or under this Act.

Annotations

Amendments:

F4

Substituted (1.02.2021) by Investment Limited Partnerships (Amendment) Act 2020 (31/2020), s. 44(1), S.I. No. 19 of 2021.

Section 6

Section 6

Instrument of incorporation

6. (1) Any 2 or more persons, associated for any lawful purpose, may prepare or cause to be prepared an instrument to be known as an instrument of incorporation in respect of a proposed ICAV.

(2) Following the instrument’s preparation, the persons referred to in subsection (1) shall subscribe their names to the instrument of incorporation.

(3) The instrument of incorporation shall provide that—

F5[(a) the sole object of the ICAV—

(i) shall, subject to subparagraph (ii), be the collective investment of its funds in property and giving members the benefit of the results of the management of its funds, or

(ii) shall, in the case of an ICAV authorised under the UCITS Regulations, be as set out in Regulation 4(3)(a) of those Regulations,]

(b) the actual value of the paid-up share capital of the ICAV shall be at all times equal to the value of the assets of the ICAV after deduction of its liabilities,

(c) the shares of the ICAV shall, at the request of any of the shareholders, be purchased by the ICAV directly or indirectly out of the ICAV assets unless and to the extent as may be approved by the Bank and subject to such requirements as may be imposed by the Bank under this Act or any other enactment,

(d) the share capital of the ICAV shall be equal to the value for the time being of the issued share capital of the ICAV, and

(e) share capital is to be divided into a specified number of shares without assigning any nominal value to them.

(4) The Bank may specify additional matters that are to be provided for in the instrument of incorporation.

(5) In the case of a failure to comply with subsection (3) the persons who subscribed their names to the instrument of incorporation each commit a category 2 offence.

F6[(6) As respects an ICAV formed before the commencement of section 44 of the Investment Limited Partnerships (Amendment) Act 2020 and authorised under the UCITS Regulations—

(a) for a period of 12 months following the commencement of section 44 of the Investment Limited Partnerships (Amendment) Act 2020, the provisions of section 5 and this section, as they stood enacted before the commencement of that section, shall apply to the ICAV, and

(b) only on and from the expiry of that period of 12 months shall the provisions of section 5 and this section, as they stand amended by that section 44 of the Investment Limited Partnerships (Amendment) Act 2020, apply to the ICAV.]

Annotations

Amendments:

F5

Substituted (1.02.2021) by Investment Limited Partnerships (Amendment) Act 2020 (31/2020), s. 44(2)(a), S.I. No. 19 of 2021.

F6

Inserted (1.02.2021) by Investment Limited Partnerships (Amendment) Act 2020 (31/2020), s. 44(2)(b), S.I. No. 19 of 2021.

Section 7

Section 7

Registered office and head office

7. (1) An ICAV shall, at all times, have a registered office in the State to which all communications and notices may be addressed.

(2) An ICAV shall give notice in writing of any change in the situation of the registered office or head office of the ICAV, within 14 days after the date of the change, to the Bank which shall record that change.

(3) If an ICAV fails to comply with subsection (1), the ICAV and any officer of it who is in default commits a category 2 offence.

(4) If an ICAV fails to comply with subsection (2), the ICAV and any officer of it who is in default commits a category 3 offence.

Section 8

Section 8

Carrying on of business

8. (1) No business shall be carried on by an ICAV that is not an authorised ICAV.

(2) The business carried on by an authorised ICAV shall be confined to activities permitted to be carried on by—

(a) in the case of an ICAV authorised under section 19, this Act and, where applicable, the AIFM Regulations, or

(b) in the case of an ICAV authorised under the UCITS Regulations, those Regulations.

(3) If an ICAV fails to comply with subsection (1) or (2), the ICAV and any officer of it who is in default commits a category 1 offence.

Section 8A

Section 8A

F7[Capacity not limited by an ICAV’s instrument of incorporation

8A. (1) The validity of an act done by an ICAV shall not be called into question on the ground of lack of capacity by reason of anything contained in the ICAV’s instrument of incorporation.

(2) Nothing in subsection (1) affects the duty of the directors of an ICAV to observe any limitation on their powers.]

Annotations

Amendments:

F7

Inserted (1.02.2021) by Investment Limited Partnership (Amendment) Act 2020 (31/2020), s. 45, S.I. No. 19 of 2021.

Section 8B

Section 8B

F8[Effect of instrument of incorporation

8B. (1) Subject to the provisions of this Act, the instrument of incorporation shall, when registered, bind the ICAV and the members of it to the same extent as if it had been signed and sealed by each member, and contained covenants by the ICAV and each member to observe all the provisions of the instrument of incorporation and each provision of this Act, relating to Irish collective asset-management vehicles, that is applicable to the ICAV.

(2) All money payable by any member to the ICAV under the instrument of incorporation shall be a debt due from him or her to the ICAV.

(3) An action to recover a debt created by this section shall not be brought after the expiration of 12 years after the date on which the cause of action accrued.]

Annotations

Amendments:

F8

Inserted (1.02.2021) by Investment Limited Partnerships (Amendment) Act 2020 (31/2020), s. 46, S.I. No. 19 of 2021.

PART 2

Registration and Authorisation of ICAVs etc.

Chapter 1

Registration

Section 9

Section 9

Registration order

9. (1) This Chapter enables the Bank to make a registration order in respect of an ICAV.

(2) A registration order operates to effect the incorporation of the ICAV under section 15.

Section 10

Section 10

Application for registration order

10. (1) To obtain a registration order in respect of a proposed ICAV an application shall be made to the Bank.

(2) The application shall—

(a) be made in writing in such manner and form as may be specified by the Bank,

(b) contain—

(i) the instrument of incorporation (subscribed to as mentioned in section 6(2)) in respect of the ICAV, and

(ii) a statement that complies with section 11,

and

(c) contain or be accompanied by such other information as the Bank may specify for the purpose of determining the application.

(3) At any time after receiving an application and before determining it the Bank may by notice in writing require the person who made the application to provide additional information to it.

(4) Different requirements may be specified by the Bank for the purposes of subsection (2)(a) and (c) in relation to different classes of applications.

(5) The Bank may specify that information provided to it in compliance with subsection (1) or (2) be certified or attested as to its authenticity or correctness in such manner as the Bank may specify, including by statutory declaration.

(6) A person commits a category 2 offence if—

(a) for the purposes of or in connection with any application under this section, or

(b) in purported compliance with any requirement imposed on the person by or under this section,

the person provides information that is false or misleading in a material particular, knowing it to be so false or misleading or being reckless as to whether it is so false or misleading.

Section 11

Section 11

Contents of statement required by section 10(2)(b)(ii)

11. (1) A statement complies with this section if the following conditions are met.

(2) The first condition is that the statement is in writing and contains the name and the particulars specified in subsection (3) in relation to—

(a) the persons who are to be the first directors of the ICAV,

(b) the person who is, or the persons who are, to be the first secretary or joint secretaries of the ICAV, and

(c) the situation of the ICAV’s head office and registered office.

(3) The particulars referred to in subsection (2) are—

(a) in relation to a person named as a director of the ICAV—

(i) all particulars which are, in relation to a director, required pursuant to subsection (2) of section 65 to be contained in the register kept under that section, and

(ii) if the person is disqualified under the law of a country or territory other than the State (whether pursuant to an order of a judge or a tribunal or otherwise) from being appointed or acting as a director or secretary of a body corporate or an undertaking, the particulars which are required by section 66(1) to be stated in a notification under section 65(6),

and

(b) in relation to a person named as secretary, or as one of the joint secretaries, all particulars which are, in relation to the secretary or each joint secretary, required pursuant to subsection (4) of section 65 to be contained in the register kept under that section.

(4) The second condition is that the statement is signed by or on behalf of the subscribers to the instrument of incorporation and is accompanied by a consent signed by each of the persons named in the statement as a director, secretary or joint secretary to act in that capacity.

(5) The third condition is that where the application for the making of a registration order is made by a person as agent for the subscribers to the instrument of incorporation the statement so specifies and gives the name and address of the agent.

(6) The persons who are specified in the statement as the directors, secretary or joint secretaries of the ICAV shall, on the incorporation of the ICAV, be deemed to have been appointed as the first directors, secretary or joint secretaries of the ICAV, and any indication in the instrument of incorporation, as delivered to the Bank under this Part, specifying a person as a director, secretary or joint secretary of an ICAV shall be void unless such person is specified as a director, secretary or joint secretary in the statement.

Section 12

Section 12

Making of registration order

12. (1) On an application being made to it under section 10, the Bank shall make a registration order in respect of an ICAV if—

(a) it is satisfied that—

(i) the application complies with that section,

(ii) the ICAV will, on the coming into operation of the order, comply with section 13,

(iii) the ICAV will, at that time, comply with any requirements imposed by or under this Act or any other enactment in relation to applications for a registration order, and

(iv) the fee (if any) prescribed under section 32E of the Central Bank Act 1942 for the purposes of this subsection has been paid,

and

(b) it has been provided with a certificate signed by a practising solicitor to the effect that the instrument of incorporation included in the application complies with this Act and any requirements imposed by or under this Act or any other enactment in relation to the contents of instruments of incorporation.

(2) If the Bank makes a registration order under subsection (1), it shall give written notice of the registration order to the applicant.

(3) The registration order shall specify the date on which it shall come into operation.

Section 13

Section 13

Requirements referred to in section 12(1)(a)(ii)

13. (1) An ICAV complies with this section if the following conditions are met.

(2) The first condition is that the ICAV and its instrument of incorporation comply with the requirements of this Act and any requirements imposed by or under this Act or any other enactment.

(3) The second condition is that the registered office and head office of the ICAV are situated in the State.

(4) The third condition is that the ICAV has at least 2 directors.

(5) The fourth condition is that the name of the ICAV complies with section 29.

Section 14

Section 14

Registration of certain matters following making of registration order

14. (1) On making a registration order in respect of an ICAV, the Bank shall, in a register kept by it for the purpose, enter the following:

(a) a copy of the registration order;

(b) the instrument of incorporation of the ICAV;

(c) particulars of the address of the ICAV’s head office and registered office;

(d) with respect to each person named in the statement referred to in section 10(2)(b)(ii) as being one of the first directors of the ICAV, and the person who is, or the persons who are, to be the first secretary or joint secretaries, the particulars specified in section 11(3).

(2) The Bank shall keep up-to-date the register referred to in subsection (1) so that it reflects any alterations in the instrument of incorporation, F9[change in the name of an ICAV,] changes in the situation of the registered office or head office and changes in the persons who are directors or secretaries of the ICAV.

(3) The register referred to in subsection (1) shall be kept in such form as the Bank considers appropriate and shall be made available for inspection free of charge on a website maintained or used by the Bank.

Annotations

Amendments:

F9

Inserted (1.02.2021) by Investment Limited Partnerships (Amendment) Act 2020 (31/2020), s. 47, S.I. No. 19 of 2021.

Section 15

Section 15

Commencement of registration order

15. From the coming into operation of a registration order in respect of an ICAV, the subscribers to its instrument of incorporation, together with such other persons as may from time to time become members of the ICAV, shall constitute a body corporate—

(a) with the name as registered or changed in accordance with this Act, and

(b) having perpetual succession.

Section 16

Section 16

Decision to refuse registration order

16. (1) If the Bank decides to refuse to make a registration order in response to an application under section 10, the Bank shall give written notice to the applicant of the decision.

(2) A decision to refuse to make a registration order is an appealable decision for the purposes of Part VIIA of the Central Bank Act 1942.

Chapter 2

Authorisation and approval

Section 17

Section 17

Authorisation

17. This Chapter enables the Bank to authorise an ICAV which is not authorised under the UCITS Regulations.

Section 18

Section 18

Application for authorisation

18. (1) To obtain authorisation an ICAV shall make an application to the Bank.

(2) The application shall—

(a) be made in writing in such manner and form as may be specified by the Bank,

(b) contain—

(i) a statement of the general nature of the investment objectives of the ICAV,

(ii) if the ICAV is not authorised under the AIFM Regulations, the full name and address of the proposed external AIFM within the meaning of the AIFM Regulations, and

(iii) the full name and address of the proposed depositary,

and

(c) contain or be accompanied by such other information as the Bank may specify for the purpose of determining the application.

(3) At any time after receiving an application and before determining it the Bank may by notice in writing require the person who made the application to provide additional information to it.

(4) Different requirements may be specified by the Bank for the purposes of subsection (2)(b) and (c) in relation to different classes of applications.

(5) The Bank may specify that information provided to it in compliance with subsection (1) be certified or attested as to its authenticity or correctness in such manner as the Bank may specify, including by statutory declaration.

(6) A person commits a category 2 offence if—

(a) for the purposes of or in connection with any application under this section, or

(b) in purported compliance with any requirement imposed on the person by or under this section,

the person provides information that is false or misleading in a material particular, knowing it to be so false or misleading or being reckless as to whether it is so false or misleading.

Section 19

Section 19

Grant of authorisation

19. (1) On an application made to it by an ICAV under section 18, the Bank shall grant an authorisation in respect of the ICAV if—

(a) it is satisfied that—

(i) the application complies with that section, and

(ii) the ICAV, when authorised, will be capable of complying with the conditions imposed by the Bank under section 27 and any requirements imposed by or under any enactment or financial services legislation,

(b) the Bank has approved the proposed depositary under section 21,

(c) if there is to be a management company, the Bank has approved the proposed management company under section 23, and

(d) the Bank is satisfied that—

(i) the directors of the ICAV are fit and proper persons,

(ii) the experience and expertise of the directors of the ICAV, taken together, is appropriate for the purposes of carrying on the business of an ICAV,

(iii) the name of the ICAV complies with section 29, and

(iv) the fee (if any) prescribed under section 32E of the Central Bank Act 1942, for the purposes of this subsection has been paid.

(2) If the Bank grants an authorisation under subsection (1), it shall give written notice of the authorisation to the ICAV.

(3) The authorisation shall specify the date on which it shall come into operation.

Section 20

Section 20

Decision to refuse authorisation

20. (1) The Bank may refuse an application for authorisation under section 18 if the Bank is not satisfied that authorisation would be in the interests of the proper and orderly regulation of the ICAV or the application for authorisation of an ICAV has failed to comply with section 18.

(2) If the Bank decides to refuse to grant an authorisation in response to an application under section 18, the Bank shall give written notice to the applicant of the decision.

(3) A decision to refuse to grant an authorisation is an appealable decision for the purposes of Part VIIA of the Central Bank Act 1942.

Section 21

Section 21

Appointment and approval of depositary

21. (1) An ICAV which is not authorised under the UCITS Regulations shall appoint a depositary.

(2) An application for approval of a depositary shall be made in writing to the Bank in such manner and form as may be specified by the Bank and shall contain or be accompanied by such other information as the Bank may specify for the purpose of determining the application.

(3) At any time after receiving an application and before determining it the Bank may by notice in writing require the person who made the application to provide additional information to it.

(4) The Bank may specify that information provided to it in compliance with subsection (2) or (3) be certified or attested as to its authenticity or correctness in such manner as the Bank may specify, including by statutory declaration.

(5) A person commits a category 2 offence if—

(a) for the purposes of or in connection with any application under this section, or

(b) in purported compliance with any requirement imposed on the person by or under this section,

the person provides information that is false or misleading in a material particular, knowing it to be so false or misleading or being reckless as to whether it is so false or misleading.

(6) The Bank may approve a depositary if satisfied that the depositary will be in a position to comply with any conditions imposed by the Bank under section 27.

(7) The Bank may refuse an application for approval under this section if the Bank is not satisfied that approval would be in the interests of the proper and orderly regulation of an ICAV or the application for approval of a depositary has failed to comply with this section.

(8) If the Bank decides to refuse to grant an approval in response to an application under this section, the Bank shall give written notice to the applicant of the decision.

(9) A decision to refuse to grant an approval is an appealable decision for the purposes of Part VIIA of the Central Bank Act 1942.

Section 22

Section 22

Application for approval of management company

22. (1) An application for approval of a management company shall be made in writing to the Bank in such manner and form as may be specified by the Bank and shall contain or be accompanied by such other information as the Bank may specify for the purpose of determining the application.

(2) At any time after receiving an application and before determining it the Bank may by notice in writing require the person who made the application to provide additional information to it.

(3) The Bank may specify that information provided to it in compliance with subsection (1) be certified or attested as to its authenticity or correctness in such manner as the Bank may specify, including by statutory declaration.

(4) A person commits a category 2 offence if—

(a) for the purposes of or in connection with any application under this section, or

(b) in purported compliance with any requirement imposed on the person by or under this section,

the person provides information that is false or misleading in a material particular, knowing it to be so false or misleading or being reckless as to whether it is so false or misleading.

Section 23

Section 23

Approval of management company

23. On an application made to it by an ICAV under section 22, the Bank shall approve a management company if the management company is—

(a) an alternative investment fund manager authorised by the Bank under Part 2 of the AIFM Regulations or by the competent authority in its home Member State in accordance with Chapter II of Directive 2011/61/EC of the European Parliament and of the Council of 8 June 2011 1, or

(b) the Bank is satisfied that—

(i) the competence of the management company in respect of matters of the kind with which it would be concerned in relation to an ICAV and its probity are such as to render it suitable to act as management company,

(ii) the management company is a body corporate that is incorporated under the law of the State and has, in the opinion of the Bank, sufficient financial resources at its disposal to enable it to conduct its business effectively and meet its liabilities, and

(iii) the management company will be in a position to comply with any conditions imposed by the Bank under section 27.

Section 24

Section 24

Refusal to approve management company

24. (1) The Bank may refuse an application for approval under section 22 if the Bank is not satisfied that approval would be in the interests of the proper and orderly regulation of the ICAV or the application for approval has failed to comply with section 22.

(2) If the Bank decides to refuse to grant an approval in response to an application under section 22, the Bank shall give written notice to the applicant of the decision.

(3) A decision to refuse to grant an approval is an appealable decision for the purposes of Part VIIA of the Central Bank Act 1942.

Section 25

Section 25

Authorisation or approval not a warranty

25. The authorisation by the Bank of an ICAV or the approval of a depositary or management company shall not constitute a warranty by the Bank as to the performance of the ICAV, depositary or management company and the Bank shall not be liable for the performance or default of an ICAV, depositary or management company.

Section 26

Section 26

Revocation of authorisation

26. (1) The Bank may revoke an authorisation under section 19 if it appears to the Bank that—

(a) any requirement for the granting of the authorisation is no longer satisfied,

(b) the ICAV, any of its directors or its secretary or any of its secretaries, its depositary or (if it has one) its management company—

(i) has seriously or systematically contravened financial services legislation, or

(ii) in purported compliance with any requirement imposed by or under financial services legislation, has furnished information to the Bank that is false or misleading in a material particular, knowing it to be so false or misleading or being reckless as to whether it is so false or misleading,

(c) the ICAV has not carried on the business of an authorised ICAV in the previous 6 months, or

(d) it is desirable to do so in order to protect the interests of shareholders or potential shareholders in the ICAV.

(2) For the purposes of subsection (1)(b), the Bank may take into account any matter relating to, as appropriate—

(a) the ICAV, its depositary or (if it has one) its management company,

(b) any director or secretary of the ICAV,

(c) any director of the depositary or management company,

(d) any person employed by or associated, for the purposes of the business of the ICAV, with the ICAV, depositary or management company,

(e) any person exercising influence over any director of the ICAV, depositary or management company,

(f) any body corporate in the same group of bodies corporate as the ICAV, depositary or management company,

(g) any director of any such body corporate, or

(h) any person exercising influence over any such body corporate.

(3) Before revoking an authorisation under subsection (1) the Bank shall ensure that such steps as are necessary and appropriate to secure the winding up of the ICAV (whether by the court or otherwise) have been taken.

(4) The Bank may revoke an authorisation granted to an ICAV under section 19 at the written request of the ICAV, its depositary or (if it has one) its management company.

(5) Where the Bank proposes to revoke the authorisation of an ICAV otherwise than at the request of the ICAV, its depositary or its management company, it shall give notice in writing to each of them of its intention to do so, stating the reasons for which it proposes to act and giving particulars of the rights conferred by subsection (6) .

(6) An ICAV, depositary or management company on whom a notice is served under subsection (5) may, within 14 days after the date of service, make representations in writing to the Bank.

(7) The Bank shall have regard to any representations made in accordance with subsection (6) in determining whether to revoke the authorisation.

Section 27

Section 27

Imposition of conditions by Bank

27. (1) The Bank may, by notice in writing, impose such conditions for—

(a) the granting of an authorisation of an ICAV,

(b) the granting of an approval of a depositary, or

(c) the granting of an approval of a management company,

under this Chapter as the Bank considers appropriate and prudent for the purposes of the orderly and proper regulation of the business of Irish collective asset-management vehicles, depositaries or management companies.

(2) Conditions imposed under subsection (1) may be imposed generally, in relation to particular classes of ICAV, depositaries or management companies or in relation to a particular ICAV, depositary or management company or by reference to any other matter that the Bank considers appropriate and prudent for the purposes of the orderly and proper regulation of the ICAV, depositary or management company.

(3) Without prejudice to the generality of subsections (1)and (2) the conditions imposed may include conditions relating to (in particular)—

(a) the investment policies of an ICAV,

(b) the issuing and content of documentation and other information disseminated by an ICAV,

(c) the criteria for appointment of a depositary,

(d) the vesting of the assets or specified assets of an ICAV in a person nominated by the Bank with such of the powers or duties of a depositary with regard to the ICAV as are specified by the Bank,

(e) the vesting of the assets or specified assets of an ICAV in a depositary,

(f) borrowing policies of an ICAV, or

(g) the timing and contents of reports issued by an ICAV,

and such other supervisory and reporting conditions relating to the business of an ICAV as the Bank considers appropriate and prudent to impose on the ICAV, depositary or management company.

(4) The power to impose conditions referred to in subsection (1) includes a power to impose such further conditions from time to time as the Bank considers appropriate and prudent for the purposes of the orderly and proper regulation of the business of Irish collective asset-management vehicles, depositaries and management companies.

(5) The Bank may, from time to time, by notice in writing given to an ICAV, depositary or management company, vary or revoke a condition imposed in accordance with subsection (1) or (4) or previously varied in accordance with this subsection.

Section 28

Section 28

Prohibition on carrying on business as ICAV unless authorised etc.

28. (1) Neither a body that is not an authorised ICAV nor an individual shall carry on any business under a name which includes, as its last part, the words “Irish Collective Asset-management Vehicle” or the abbreviation “ICAV”.

(2) Neither a body that is not an ICAV nor an individual shall in any other manner make a representation that the body or the individual is an ICAV.

(3) A person who contravenes subsection (1) or (2) commits a category 2 offence.

Chapter 3

Names and changes in instrument of incorporation

Section 29

Section 29

Name of ICAV

29. (1) The name of an ICAV shall end with one of the following:

(a) Irish Collective Asset-management Vehicle;

(b) ICAV.

(2) The name of an ICAV shall not be, such as is in the opinion of the Bank, undesirable or misleading.

Section 30

Section 30

Approval for change of name

30. (1) If an ICAV proposes to change the name by which it is incorporated, it shall not do so unless the change is approved by the Bank as being neither undesirable nor misleading on an application under this section.

(2) If an ICAV purports to change the name by which it is incorporated without first obtaining the approval of the Bank under this section, the ICAV and any officer of it who is in default commits a category 3 offence.

F10[(3) If an ICAV changes its name in accordance with this section, then, in addition to fulfilling the requirement under section 14(2) to update the register of ICAVs so as to reflect that change, the Bank shall—

(a) alter the copy of the registration order, relating to the ICAV, entered in that register so that it contains the new name, and

(b) give written notice of that alteration to the ICAV.]

Annotations

Amendments:

F10

Inserted (1.02.2021) by Investment Limited Partnerships (Amendment) Act 2020 (31/2020), s. 48, S.I. No. 19 of 2021.

Section 31

Section 31

Alteration in instrument of incorporation

31. (1) No alteration in the instrument of incorporation of an ICAV shall be made unless—

(a) the alteration has been approved—

(i) by ordinary resolution, or

(ii) if the instrument of incorporation so requires, by a resolution passed by such majority as is specified in the instrument of incorporation of the votes cast by the members of the ICAV who, being entitled to do so, vote in person or by proxy at a general meeting of the ICAV,

or

(b) the depositary of the ICAV has certified in writing that the alteration—

(i) does not prejudice the interests of the members of the ICAV, and

(ii) does not relate to any such matter as may be specified by the Bank as one in the case of which an alteration may be made only if approved by members of an ICAV.

(2) No alteration in the instrument of incorporation of an ICAV shall be made without the approval of the Bank.

(3) Any person who makes an alteration in the instrument of incorporation of an ICAV otherwise than in accordance with subsections (1) and (2) commits a category 3 offence.

(4) Within 21 days after the date of the making of an alteration in the instrument of incorporation of an ICAV, the ICAV shall deposit with the Bank a copy of the instrument of incorporation as so altered or containing the alterations.

(5) If an ICAV fails to comply with subsection (4), it commits a category 2 offence.

(6) In this section “alteration in the instrument of incorporation” does not include a change in the name of the ICAV.

Chapter 4

Execution of documents, seals, etc.

Section 32

Section 32

Execution of documents

32. (1)Contracts on behalf of an ICAV may be made as follows:

(a) a contract which, if made between natural persons, would be by law required to be in writing and to be under seal, may be made on behalf of the ICAV in writing under the common seal of the ICAV in accordance with this section;

(b) a contract which, if made between natural persons, would be by law required to be in writing, signed by the parties, may be made on behalf of the ICAV in writing, signed by any person acting under its authority, express or implied;

(c) a contract which, if made between natural persons, would by law be valid although made by parol only, and not reduced into writing, may be made by parol on behalf of the ICAV by any person acting under its authority, express or implied.

(2) A contract made according to this section shall bind the ICAV and its successors and all other parties to it.

(3) A contract made according to this section may be varied or discharged in the same manner in which it is authorised by this section to be made.

(4) The following provisions of this section shall apply whether it is the case that—

(a) as permitted by section 33, the ICAV does not have a common seal, or

(b) the ICAV does have such a seal.

(5) A document has the same effect as if executed under the common seal of the ICAV F11[(that is to say, executed under the ICAV’s common seal in compliance with section 33(4))] if it is expressed (in whatever form of words) to be executed by the ICAV and it is signed on behalf of the ICAV—

(a) by 2 authorised signatories, or

(b) by a director of the ICAV in the presence of a witness who attests the signature.

(6) Each of the following is an authorised signatory for the purposes of subsection (5):

(a) a director of the ICAV;

(b) the secretary (or any joint secretary) of the ICAV; or

(c) any person authorised by the directors of the ICAV in accordance with the ICAV’s instrument of incorporation.

(7) F12[…]

(8) References in this section to a document being (or purporting to be) signed by a secretary are to be read, in a case where that office is held by a firm, as references to its being (or purporting to be) signed by an individual authorised by the firm to sign on its behalf.

Annotations

Amendments:

F11

Inserted (1.02.2021) by Investment Limited Partnership (Amendment) Act 2020 (31/2020), s. 49(a), S.I. No. 19 of 2021.

F12

Deleted (1.02.2021) by Investment Limited Partnership (Amendment) Act 2020 (31/2020), s. 49(b), S.I. No. 19 of 2021.

Section 33

Section 33

Common seal

33. (1) An ICAV may provide itself with a common seal (but there is no requirement that it shall have such a seal).

(2) An ICAV which has a common seal shall have its name engraved in legible characters on the seal.

(3) A person who is an officer of an ICAV, or a person acting on behalf of an ICAV, commits a category 3 offence by using, or authorising the use of, a seal purporting to be a seal of the ICAV on which its name is not engraved as required by subsection (2).

F13[(4) Save as otherwise provided by this Act or by the instrument of incorporation of the ICAV—

(a) an ICAV’s common seal shall be used only by the authority of its directors, or of a committee of its directors authorised by its directors in that behalf, and

(b) any instrument to which an ICAV’s common seal shall be affixed shall be—

(i) signed by a director of it or by some other person appointed for the purpose by its directors or by a foregoing committee of them, and

(ii) be countersigned by the secretary or by a second director of it or by some other person appointed for the purpose by its directors or by a foregoing committee of them.]

Annotations

Amendments:

F13

Inserted (1.02.2021) by Investment Limited Partnerships (Amendment) Act 2020 (31/2020), s. 50, S.I. No. 19 of 2021.

Section 34

Section 34

Official seal for share certificates

34. (1) An ICAV which has a common seal may have, for use for sealing shares issued by the ICAV and for sealing documents creating or evidencing shares so issued, an official seal which is a facsimile of its common seal with the addition on its face of the word “securities”.

(2) The official seal when duly affixed to a document has the same effect as the ICAV’s common seal.

Section 34A

Section 34A

F14[Powers of attorney

34A. (1) Notwithstanding anything in its instrument of incorporation, an ICAV may empower any person, either generally or in respect of any specified matters, as its attorney, to execute deeds or do any other matter on its behalf in any place whether inside or outside the State.

(2) A deed signed by such attorney on behalf of the ICAV shall bind the ICAV and have the same effect as if it were under its common seal.]

Annotations

Amendments:

F14

Inserted (1.02.2021) by Investment Limited Partnerships (Amendment) Act 2020 (31/2020), s. 51, S.I. No. 19 of 2021.

Chapter 5

Sub-funds of umbrella funds

Section 35

Section 35

Segregated liability of ICAV sub-funds

35. Despite any enactment or rule of law to the contrary—

(a) any liability incurred on behalf of or attributable to any sub-fund of an umbrella fund shall be discharged solely out of the assets of that sub-fund, and

(b) no umbrella fund or any director, receiver, liquidator, provisional liquidator or other person shall apply, or be obliged to apply, the assets of any such sub-fund in satisfaction of any liability incurred on behalf of or attributable to any other sub-fund of the same umbrella fund.

Section 36

Section 36

Requirements to be complied with by, and other matters respecting, an umbrella fund

36. (1) An umbrella fund to which section 35 applies shall—

(a) ensure that the words “An umbrella fund with segregated liability between sub-funds” are included in all its letterheads and in any agreement entered into by it in writing with a third party, and

(b) disclose to a third party that it is a segregated liability umbrella fund before it enters into an oral contract with the third party.

(2) If an umbrella fund fails to comply with subsection (1)(a) or (b), the umbrella fund and any officer of it who is in default commits a category 3 offence.

(3) There shall be implied in every contract, agreement, arrangement or transaction entered into by an umbrella fund to which section 35 applies the following terms:

(a) the party or parties contracting with the umbrella fund shall not seek, whether in any proceedings or by any other means whatsoever or wherever, to have recourse to any assets of any sub-fund of the umbrella fund in the discharge of all or any part of a liability which was not incurred on behalf of that sub-fund;

(b) if any party contracting with the umbrella fund shall succeed by any means whatsoever or wherever in having recourse to any assets of any sub-fund of the umbrella fund in the discharge of all or any part of a liability which was not incurred on behalf of that sub-fund, that party shall be liable to the umbrella fund to pay a sum equal to the value of the benefit thereby obtained by it;

(c) if any party contracting with the umbrella fund shall succeed in seizing or attaching by any means, or otherwise levying execution against, any assets of a sub-fund of an umbrella fund in respect of a liability which was not incurred on behalf of that sub-fund, that party shall hold those assets or the direct or indirect proceeds of the sale of such assets on trust for the umbrella fund and shall keep those assets or proceeds separate and identifiable as such trust property.

(4) All sums recovered by an umbrella fund as a result of any such trust as is described in subsection (3) (c) shall be credited against any concurrent liability pursuant to the implied term set out in subsection (3)(b).

(5) Any asset or sum recovered by an umbrella fund pursuant to the implied term set out in paragraph (b) or (c) of subsection (3) or by any other means whatsoever or wherever in the events referred to in those paragraphs shall, after the deduction or payment of any costs of recovery, be applied so as to compensate the sub-fund affected.

(6) In the event that assets attributable to a sub-fund to which section 35 applies are taken in execution of a liability not attributable to that sub-fund, and in so far as such assets or compensation in respect thereof cannot otherwise be restored to that sub-fund affected, the directors of the umbrella fund, with the consent of the depositary, shall certify or cause to be certified, the value of the assets lost to the sub-fund affected and transfer or pay from the assets of the sub-fund or sub-funds to which the liability was attributable, in priority to all other claims against such sub-fund or sub-funds, assets or sums sufficient to restore to the sub-fund affected, the value of the assets or sums lost to it.

Section 37

Section 37

Further matters about umbrella funds

37. (1) Without prejudice to the other provisions of this Chapter, a sub-fund of an umbrella fund is not a legal person separate from that umbrella fund, but an umbrella fund may sue and be sued in respect of a particular sub-fund and may exercise the same rights of set-off, if any, as between its sub-funds as apply at law in respect of an ICAV and the property of a sub-fund is subject to orders of the High Court as it would have been if the sub-fund were a separate legal person.

(2) Nothing in this Chapter shall prevent the application of any enactment or rule of law which would require the application of the assets of any sub-fund in discharge of some or all of the liabilities of any other sub-fund on the grounds of fraud or misrepresentation.

(3) A sub-fund may be wound up as if the sub-fund were a separate ICAV but, in any such case, the appointment of the liquidator or any provisional liquidator and the powers, rights, duties and responsibilities of the liquidator or any provisional liquidator shall be confined to the sub-fund or sub-funds which is or are being wound up.

(4) For the purposes of subsection (3), all references in enactments relating to the winding up of an ICAV to one of the following words shall be read as follows:

(a) “ICAV” shall be read as referring to the sub-fund or sub-funds which is or are being wound up;

(b) a “member” or “members” shall be read as referring to the holders of the shares in that sub-fund or sub-funds;

(c) “creditors” shall be read as referring to the creditors of that sub-fund or sub- funds.

PART 3

Shares and Debentures etc.

Section 38

Section 38

Power to issue shares and debentures

38. (1) An ICAV may issue shares and debentures according to its instrument of incorporation, its prospectus, Bank regulations and conditions imposed under section 27.

(2) An ICAV may issue shares as fully paid up, or subscribed and partly paid up, in such manner as may be provided by its instrument of incorporation and in accordance with its prospectus, Bank regulations and conditions imposed under section 27.

(3) An ICAV may issue more than one class of shares, and may create more than one sub- fund, in accordance with its instrument of incorporation, its prospectus, Bank regulations and conditions imposed under section 27.

(4) The assets of an ICAV shall belong exclusively to the ICAV and no shareholder has any interest in the assets of the ICAV.

(5) The rights which attach to each share of an ICAV of any given class are the following:

(a) the right, in accordance with the instrument of incorporation of the ICAV, to participate in or receive profits or income arising from the acquisition, holding, management or disposal of assets of the ICAV;

(b) the right, in accordance with the instrument of incorporation of the ICAV, to vote at any general meeting of the ICAV or at any meeting of shareholders of that class of shares;

(c) such other rights as may be provided for in the instrument of incorporation of the ICAV in relation to shares of that class, subject to Bank regulations and conditions imposed under section 27.

(6) In respect of any class of shares, the rights referred to in subsection (5) may, if the instrument of incorporation of the ICAV so provides, be expressed in one or more denominations.

Section 39

Section 39

Share certificates

39. (1) Subject to subsection (3), to Bank regulations and conditions imposed under section 27, an ICAV shall prepare and have ready for delivery the certificates of all shares and debentures allotted or transferred, in accordance with its instrument of incorporation.

(2) In subsection (1) “transfer” means a transfer that is (where appropriate) duly stamped and is otherwise valid, and does not include such a transfer as the ICAV is, for any reason, entitled to refuse to register and does not register.

(3) Subsection (1) does not require an ICAV to prepare share certificates in the following circumstances:

(a) where the ICAV’s instrument of incorporation states that share certificates will not be issued and contains provision for the issue of written confirmations of entry in the register of members;

(b) where the shareholder has indicated to the ICAV in writing that the shareholder does not wish to receive a certificate.

(4) If an ICAV fails to comply with subsection (1) the ICAV and any officer of it who is in default commits a category 3 offence.

Section 40

Section 40

Evidence of share certificate

40. A certificate under the common seal of an ICAV, or the seal kept by an ICAV pursuant to section 34, specifying any shares held by any member shall be prima facie evidence of the title of the member to the shares.

Section 41

Section 41

Nature of shareholding

41. The shares or other interest of any member in an ICAV shall be personal property, transferable, subject to the provisions of this Act, Bank regulations and conditions imposed under section 27, in a manner provided by the instrument of incorporation of the ICAV and shall not be of the nature of real property.

Section 42

Section 42

Transfer of registered shares

42. (1) Subject to subsection (2), and despite anything in the instrument of incorporation of an ICAV, it shall not be lawful for the ICAV to register a transfer of shares in or debentures of the ICAV unless a proper instrument of transfer has been delivered to the ICAV.

(2) Nothing in subsection (1) shall prejudice any power of the ICAV to register as shareholder or debenture holder any person to whom the right to any shares in, or debentures of, the ICAV has been transmitted by operation of law.

(3) If an ICAV registers a transfer in contravention of this section the ICAV and any officer of it who is in default commits a category 3 offence.

(4) In this section “instrument of transfer” means such evidence as is required to prove the right of the transferor to transfer the shares as set out in the instrument of incorporation of the ICAV or the prospectus of the ICAV.

Section 43

Section 43

Refusal to register transfer of shares

43. (1) An ICAV may, before the end of the period of 2 months commencing with the date of receipt of the transfer documents relating to any transfer of shares, refuse to register the transfer if—

(a) there exists a minimum requirement as to the number or value of shares that are to be held by any shareholder of the ICAV and the transfer would result in either the transferor or transferee holding less than the required minimum, or

(b) the transfer would result in a contravention of any provision of the ICAV’s instrument of incorporation or would produce a result inconsistent with any provision of the ICAV’s prospectus.

(2) An ICAV shall give the transferee written notice of any refusal to register a transfer of shares.

(3) But an ICAV is not required to register a transfer or give notice to any person of a refusal to register a transfer where registering the transfer or giving the notice would result in a contravention of any provision of law (including any law that is for the time being in force in a country or territory other than the State).

(4) If an ICAV fails to give notice as required by subsection (2) the ICAV and any officer of it who is in default commits a category 3 offence.

Section 44

Section 44

Certification of transfer of shares

44. (1) The certification by an ICAV of any instrument of transfer of shares in or debentures of the ICAV shall be taken as a representation by the ICAV to any person acting on the faith of the certificate that there have been produced to the ICAV such documents as on the face of them show a prima facie title to the shares or debentures in the transferor named in the instrument of transfer, but not as a representation that the transferor has any title to the shares or debentures.

(2) For the purposes of subsection (1), an instrument shall be deemed to be certified if—

(a) the instrument bears the words “certificate lodged” (or words to the same effect), and

(b) the instrument is signed by a person acting under authority (whether express or implied) given by the ICAV to issue and sign such certificates.

(3) For the purposes of subsection (2), a certificate shall be deemed to be signed by any person if—

(a) it purports to be authenticated by the person’s signature or initials (whether hand written or not), and

(b) it is not shown that the signature or initials was or were placed there neither by the person nor by any person authorised to use the signature or initials for the purpose of certifying transfers on the ICAV’s behalf.

(4) Where any person acts on the faith of a false certificate by an ICAV made negligently, the ICAV shall be under the same liability to the person as if the certificate had been made fraudulently.

Section 45

Section 45

Transfer: supplementary

45. (1) Nothing in the preceding provisions of this Part prejudices any power of an ICAV to register as shareholder or debenture holder any person to whom the right to any shares in or debentures of the ICAV has been transmitted by operation of law.

(2) A transfer of registered shares or other interest of a deceased member of an ICAV made by the deceased member’s personal representatives shall, although the personal representatives are not members of the ICAV, be as valid as if they had been such a member at the time of the execution of the instrument of transfer.

(3) On the death of any one of the joint holders of any shares in an ICAV, the survivor is to be the only person recognised by the ICAV as having any title to or any interest in those shares.

(4) The production to an ICAV of any document which is by law sufficient evidence of probate of the will or letters of administration of the estate of a deceased person having been granted to some person shall be accepted by the ICAV, despite anything in its instrument of incorporation, as sufficient evidence of the grant.

Section 46

Section 46

Power to purchase own shares

46. (1) Subject to subsection (2), the purchase by an ICAV of its own shares shall be on such terms and in such manner as may be provided by its instrument of incorporation and in accordance with Bank regulations and conditions imposed under section 27.

(2) An ICAV shall not purchase its own shares unless they are fully paid, but nothing in this subsection shall prevent a purchase being made in accordance with section 47(2).

(3) But an ICAV is not required to create any reserve account.

(4) If an ICAV fails to comply with subsection (2) the ICAV and any officer of it who is in default commits a category 3 offence.

Section 47

Section 47

Treatment of purchased shares

47. (1) Shares of an ICAV which have been purchased by or otherwise transferred to the ICAV shall be cancelled and the amount of the issued share capital of the ICAV shall be reduced by the amount of the consideration paid by the ICAV for the purchase or other transfer of the shares.

(2) Despite subsection (1), an umbrella fund may, for the account of any of its sub-funds, and in accordance with conditions imposed by the Bank, acquire by subscription or transfer for consideration, shares of any class or classes, however described, representing other sub-funds of the same umbrella fund.

Section 48

Section 48

Membership

48. Every person who agrees to become a member of an ICAV, and whose name is entered on its register of members, shall be a member of the ICAV.

Section 49

Section 49

Register of members

49. (1) An ICAV shall keep a register of its members and enter in it the following particulars:

(a) the names and addresses of the members and a statement of the shares held by each member, distinguishing each share by its number so long as the share has a number, the sub-fund (if any) and share class (if any) of such sub-fund to which the share belongs and any amount paid or agreed to be considered as paid on the shares held by each member;

(b) the date at which each person was entered in the register as a member;

(c) the date at which any person ceased to be a member.

(2) The entries required under subsection (1)(a) and (b) shall be made within 2 days after the date of the conclusion of the agreement with the ICAV to become a member.

(3) The entry required under subsection (1)(c) shall be made—

(a) within 2 days after the date when the person concerned ceased to be a member, or

(b) if the person ceased to be a member otherwise than as a result of action by the ICAV, within 2 days after the date of the production to the ICAV of evidence satisfactory to the ICAV of the occurrence of the event whereby the person ceased to be a member.

(4) If an ICAV fails to comply with any of subsections (1) to (3), the ICAV and any officer of it who is in default commits a category 3 offence.

Section 50

Section 50

Inspection of register of members

50. (1) Subject to subsection (2), the register of members shall be kept available for inspection by a person entitled to inspect it—

(a) at the registered office of the ICAV, or

(b) at an alternative place notified to the Bank under subsection (3) as the place where the register of members is kept.

(2) The register of members shall not be kept at a place outside the State.

(3) Subject to subsection (4), every ICAV shall send notice to the Bank of the place where its register of members is kept and of any change in that place.

(4) An ICAV shall not be bound to send notice under subsection (3) where the register has, at all times since it came into existence, been kept at the registered office of the ICAV.

(5) If an ICAV fails to comply with any of subsections (1) to (3), the ICAV and any officer of it who is in default commits a category 3 offence.

(6) The persons entitled to inspect the register of members of an ICAV are—

(a) the Bank,

(b) the Director of Corporate Enforcement, and

(c) any statutory body which needs to inspect the register in order properly to exercise any of its functions.

Section 51

Section 51

Consequences of failure to comply with requirements as to register owing to agent’s default